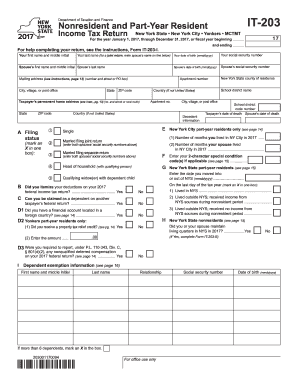

Get Ny It-203 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY IT-203 online

How to fill out and sign NY IT-203 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans generally prefer to handle their own income tax filings and additionally to complete reports electronically.

The US Legal Forms online service streamlines the preparation of the NY IT-203, making it quick and straightforward.

Ensure that you have accurately completed and submitted the NY IT-203 on time. Consider any relevant deadlines. Submitting incorrect information on your financial documents can lead to substantial penalties and complicate your yearly tax return. Use only verified templates from US Legal Forms!

- Launch the PDF template in the editor.

- Look at the highlighted fillable fields. You can enter your details here.

- Select the option if you see the checkboxes.

- Go to the Text icon and other advanced features to modify the NY IT-203 manually.

- Review every detail prior to proceeding with your signature.

- Create your personalized eSignature using a keypad, camera, touchscreen, mouse, or smartphone.

- Authorize your document online and enter the specified date.

- Click Done to continue.

- Save or send the document to the intended recipient.

How to Alter Get NY IT-203 2017: Personalize Forms Online

Utilize our sophisticated editor to convert a basic online template into a finished document. Continue reading to find out how to modify Get NY IT-203 2017 online effortlessly.

Once you identify a suitable Get NY IT-203 2017, all you need to do is tailor the template to your specifications or legal obligations. Besides filling out the customizable form with precise information, you might need to delete certain clauses in the document that are irrelevant to your situation. Alternatively, you may wish to incorporate some absent terms in the original form. Our advanced document editing tools are the easiest way to rectify and adjust the form.

The editor enables you to alter the content of any form, even if the document is in PDF format. You can insert and eliminate text, add fillable fields, and implement additional modifications while maintaining the original formatting of the document. Furthermore, you can reorganize the layout of the form by adjusting the page sequence.

You don’t have to print the Get NY IT-203 2017 to endorse it. The editor includes electronic signature capabilities. Most forms already have signature fields, so you simply need to affix your signature and request one from the other signing party with just a few clicks.

Follow this step-by-step guide to create your Get NY IT-203 2017:

After all parties sign the document, you will receive a signed version which you can download, print, and distribute to others.

Our services allow you to save a significant amount of time and reduce the likelihood of errors in your documents. Optimize your document workflows with efficient editing tools and a robust eSignature solution.

- Open the desired form.

- Utilize the toolbar to modify the form to your preferences.

- Fill in the form providing accurate information.

- Click on the signature field and enter your eSignature.

- Send the document for signing to other participants if necessary.

Get form

Writing a check for income tax is straightforward. Begin by writing the date at the top right corner, followed by the payee, which is often 'Department of Taxation and Finance.' Specify the amount in numbers and in words, and include your tax identification number in the memo line for proper credit. By using the correct form, like the NY IT-203, you contribute to a smooth tax payment process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.