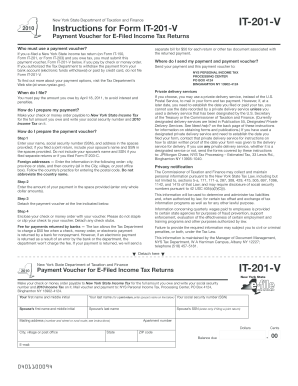

Get Ny It-201-v 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY IT-201-V online

How to fill out and sign NY IT-201-V online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, a majority of Americans prefer to handle their own taxes and, in addition, to complete reports electronically.

The US Legal Forms online service assists in making the task of completing the NY IT-201-V straightforward and convenient.

Ensure that you have accurately filled out and submitted the NY IT-201-V on time. Consider any relevant deadlines. Providing incorrect information in your financial documents can result in severe penalties and complications with your yearly tax return. Make sure to use only official templates from US Legal Forms!

- Open the PDF template in the editor.

- Observe the highlighted fillable fields. This is where you should enter your information.

- Select the option to check if you notice the checkboxes.

- Explore the Text icon and other advanced features to manually adjust the NY IT-201-V.

- Verify all the details before you proceed to sign.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authorize your online template and add the date.

- Click on Done to continue.

- Download or send the file to the recipient.

How to Modify Get NY IT-201-V 2010: Personalize Forms Online

Make full use of our comprehensive online document editor while finalizing your paperwork.

Complete the Get NY IT-201-V 2010, highlight the most important aspects, and effortlessly make any other necessary adjustments to its content.

Filling out documents digitally is not only efficient but also allows you to revise the template according to your specifications. If you're going to work on Get NY IT-201-V 2010, think about accomplishing it with our thorough online editing tools.

Our wide-ranging online solutions are the most efficient means to complete and personalize Get NY IT-201-V 2010 per your needs. Use it to prepare personal or business paperwork from any location. Access it in a browser, make any modifications to your forms, and revisit them anytime in the future - they will all be securely saved in the cloud.

- Open the document in the editor.

- Input the required information in the blank fields using Text, Check, and Cross tools.

- Follow the document navigation to ensure you don’t overlook any essential sections in the template.

- Circle some of the significant details and add a URL to it if needed.

- Utilize the Highlight or Line tools to emphasize the most crucial facts.

- Select colors and thickness for these lines to enhance the professional appearance of your template.

- Erase or blackout the information you wish to conceal from others.

- Replace parts of the content that contain mistakes and type in the necessary text.

- Conclude editing with the Done button as soon as you are certain that everything is accurate in the document.

Get form

Filling out a withholding exemption form requires you to declare that you meet specific criteria to claim exemption. You will need to provide reasons for your exemption claim, along with your personal information. Ensure you carefully follow the instructions to avoid incorrect withholdings on your NY IT-201-V.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.