Loading

Get Ny Dtf-4.1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF-4.1 online

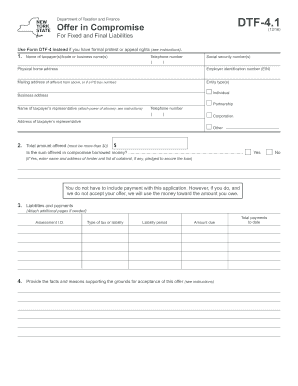

Filling out the NY DTF-4.1 form is a crucial step in submitting an offer in compromise for fixed and final liabilities. This guide will provide you with clear and detailed instructions to help you navigate each section of the form effectively.

Follow the steps to complete the NY DTF-4.1 online.

- Use the 'Get Form' button to obtain the DTF-4.1 form and open it in the appropriate platform for editing.

- Enter the name of the taxpayer(s) or trade/business name, telephone number, social security number(s), physical home address, employer identification number (EIN), mailing address if different, and entity type(s). If applicable, include the representative's name, phone number, and address while attaching the power of attorney.

- State the total amount you are offering for the compromise. Ensure the amount is greater than $0. If the amount offered is borrowed, check 'Yes' and include the lender's name and address, along with the collateral pledged.

- List your liabilities and payments. Attach additional sheets if needed. Provide the assessment I.D., type of tax or liability, liability period, and amount due.

- In this section, concisely describe the facts and reasons that support your grounds for accepting the offer. Make sure to attach any necessary documents to support your explanation.

- Review and acknowledge the conditions outlined in Section 5, understanding that acceptance of your offer will involve specific terms.

- Sign and date the form, ensuring that all required sections are complete. If applicable, include the required signatures of all parties involved, especially in joint liability cases.

- Check that you have included all supporting documents, such as Form DTF-5, federal income tax returns for the last three years, a recent credit report, and bank statements from the last 12 months.

- Once all sections are reviewed and completed, you can save changes, download, print, or share the form to submit your application.

Start completing your NY DTF-4.1 form online today to take the first step towards resolving your tax liabilities.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

NYS DTF payment refers to the payments you make to the New York State Department of Taxation and Finance for owed taxes. Timely payments help you maintain compliance and avoid penalties. When dealing with payments, many businesses find it easier to manage their tax obligations with the NY DTF-4.1 and tools offered by platforms like uslegalforms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.