Loading

Get Ca Ftb 540 Instructions 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 540 Instructions online

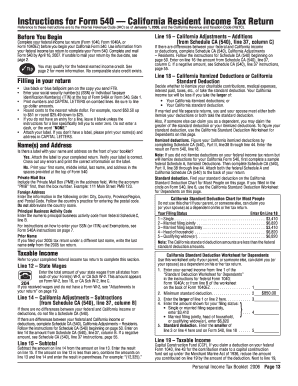

This guide provides clear and supportive step-by-step instructions to assist users in effectively completing the CA FTB 540 form online. Designed for a broad audience, the instructions aim to simplify the online filing process for all users, regardless of experience level.

Follow the steps to confidently complete your CA FTB 540 Instructions online.

- Press the ‘Get Form’ button to obtain the CA FTB 540 Instructions in a suitable format for online filling.

- Begin by ensuring you have completed your federal income tax return (Form 1040, 1040A, or 1040EZ). Gather information from this document to accurately fill out the California Form 540.

- Fill in your social security number (SSN) or Individual Taxpayer Identification Number (ITIN) at the top of Form 540A or Form 540, Side 1. Ensure that you use capital letters and align dollar amounts appropriately.

- When entering your name(s) and address, verify if you have a pre-printed label. If yes, affix it to your completed return; if not, print your name(s) and address in capital letters in the designated space.

- In the Taxable Income section, refer to your completed federal income tax return and enter the necessary figures as specified in the instructions for each line.

- As you progress through the form, remember to round all cent amounts to the nearest whole dollar and leave blank any lines that do not apply to your situation unless instructed otherwise.

- Complete the Tax and Exemption Credits sections carefully, ensuring to check the related instructions for specific calculations and requirements that may apply to your filing status.

- Once all fields are filled out, review the entire form for accuracy. You can save changes, download, print, or share the final version depending on your preference.

Start filing your CA FTB 540 Instructions online today for a smoother tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To calculate your California adjusted gross income, begin with your total income and make necessary adjustments per California tax rules. This calculation involves factors like income exclusions and deductions. By following the CA FTB 540 Instructions, you can ensure your adjusted gross income is accurate and consistent with state expectations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.