Get Ca Ftb 540 Instructions 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CA FTB 540 Instructions online

How to fill out and sign CA FTB 540 Instructions online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

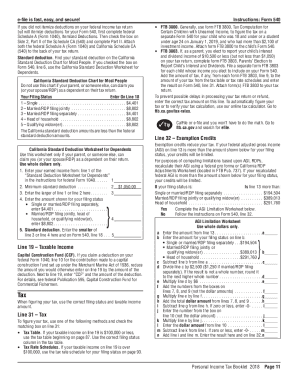

If the tax term commenced unexpectedly or perhaps you simply overlooked it, it could likely lead to complications for you. CA FTB 540 Instructions is not the simplest one, but there is no cause for alarm in any scenario.

Utilizing our expert online software, you will grasp the optimal way to complete CA FTB 540 Instructions even during times of significant time shortage. You merely need to adhere to these straightforward recommendations:

With this comprehensive digital solution and its valuable tools, submitting CA FTB 540 Instructions becomes more manageable. Do not hesitate to engage with it and enjoy more time on hobbies and interests instead of organizing documents.

- Open the document in our specialized PDF editor.

- Fill in all necessary information in CA FTB 540 Instructions, utilizing the fillable fields.

- Incorporate images, crosses, check marks, and text boxes, if necessary.

- Duplicate information will be added automatically after the initial entry.

- If you encounter any issues, activate the Wizard Tool. You will find helpful advice for smoother completion.

- Don't forget to put in the date of submission.

- Create your distinct signature once and place it in the designated lines.

- Review the information you have entered. Correct errors if required.

- Click on Done to finalize editing and choose your method of submission. You have the option of using online fax, USPS, or email.

- Additionally, you can download the document to print it later or upload it to cloud storage such as Google Drive, OneDrive, etc.

How to Alter Get CA FTB 540 Guidelines 2018: Personalize Forms Online

Utilize our comprehensive online document editor while filling out your forms.

Complete the Get CA FTB 540 Guidelines 2018, highlight the key details, and smoothly make any other essential modifications to its content.

Filling documents electronically not only saves time but also allows you to adjust the template according to your preferences. If you're preparing the Get CA FTB 540 Guidelines 2018, consider finalizing it with our powerful online editing tools. Whether you make a mistake or place the required information in the incorrect section, you can quickly revise the document without having to restart from scratch as you would with manual entry. Additionally, you can emphasize the vital information in your document by accentuating specific content with colors, underlining, or circling.

Our robust online solutions are the easiest method to fill out and personalize the Get CA FTB 540 Guidelines 2018 to suit your requirements. Use it to create personal or business documents from anywhere. Open it in a browser, make changes to your forms, and return to them at any time in the future - they will all be securely stored in the cloud.

- Access the form in the editor.

- Input the required information in the blank spaces using Text, Check, and Cross tools.

- Follow the form navigation to ensure no essential sections are overlooked in the template.

- Circle some of the important details and add a URL if necessary.

- Use the Highlight or Line options to accentuate the most crucial pieces of content.

- Choose colors and thickness for these lines to enhance the professional look of your form.

- Erase or blackout the information you wish to keep from others.

- Replace sections of content that contain errors and input the correct text.

- Conclude modifications with the Done button once you’ve confirmed everything is accurate in the form.

Related links form

The best tax guide often depends on your personal situation, but the IRS Publication 17 is a solid resource for federal tax filing. Additionally, for residents filing California taxes, referring to the CA FTB 540 instructions ensures you understand state-specific requirements. Many tax software solutions also provide comprehensive guides that may fit your needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.