Get Ny Dtf St-120.1 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF ST-120.1 online

How to fill out and sign NY DTF ST-120.1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans seem to opt for managing their personal income taxes independently and also prefer to complete forms in digital format.

The US Legal Forms online service makes the task of electronically filing the NY DTF ST-120.1 straightforward and convenient. At present, it takes no longer than half an hour, and you can accomplish it from anywhere.

Ensure that you have accurately completed and submitted the NY DTF ST-120.1 by the deadline. Consider any relevant timeline. If you submit incorrect information in your financial documents, it may lead to substantial penalties and complications with your yearly income tax submission. Utilize only reliable templates from US Legal Forms!

- Examine the PDF example in the editor.

- Look at the highlighted fillable sections. Here you can enter your information.

- Select the option if you see the checkboxes.

- Use the Text tool along with other robust features to manually modify the NY DTF ST-120.1.

- Review all the information before you continue with signing.

- Create your personalized eSignature using a keypad, camera, touchpad, mouse, or smartphone.

- Authenticate your PDF form online and indicate the date.

- Click Done to proceed.

- Download or forward the document to the intended recipient.

How to modify Get NY DTF ST-120.1 2009: personalize documents online

Select a dependable document modification service you can count on. Alter, complete, and sign Get NY DTF ST-120.1 2009 safely online.

Frequently, updating documents like Get NY DTF ST-120.1 2009 can be difficult, particularly if you received them in a digital format but lack access to specialized applications. Certainly, you can discover some alternatives to manage it, but you risk obtaining a form that won’t meet the submission criteria. Utilizing a printer and scanner is not a viable solution either, as it is time-consuming and resource-intensive.

We offer a more seamless and effective method for completing documents. A comprehensive collection of form templates that are easy to personalize and authenticate, and can be made fillable for certain users. Our service goes far beyond just a selection of templates. One of the most advantageous aspects of using our services is that you can modify Get NY DTF ST-120.1 2009 directly on our site.

As it's a web-based platform, it spares you from needing to install any software. Additionally, not all corporate policies allow for software downloads on company computers. Here’s the simplest way to smoothly and securely finalize your documents with our platform.

Bid farewell to paper and other ineffective approaches for executing your Get NY DTF ST-120.1 2009 or other documents. Opt for our solution that merges one of the largest libraries of ready-to-edit forms with robust document modification services. It's simple and secure and can save you a significant amount of time! Don’t just take our word for it, test it yourself!

- Click the Get Form > you’ll be immediately redirected to our editor.

- Once opened, you can start the personalization process.

- Select checkmark or circle, line, arrow and cross and other options to annotate your document.

- Choose the date option to add a specific date to your template.

- Insert text boxes, graphics, notes, and more to enhance the content.

- Use the fillable fields option on the right to create fillable {fields.

- Select Sign from the top toolbar to generate and create your legally-binding signature.

- Click DONE and save, print, and distribute or download the result.

Get form

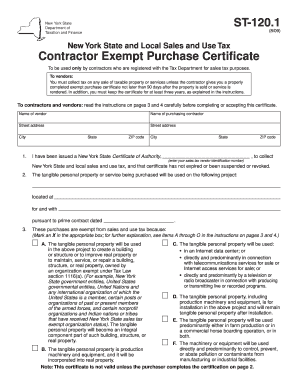

To obtain a sales tax exempt ID, you need to complete the appropriate forms with the New York State Department of Taxation and Finance. Start the process by ensuring you have your NY DTF ST-120.1 document ready, as it will be critical for verifying your exemption status. Follow the guidelines provided online to expedite your application.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.