Loading

Get Ny Dtf Rp-5217-pdf 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF RP-5217-PDF online

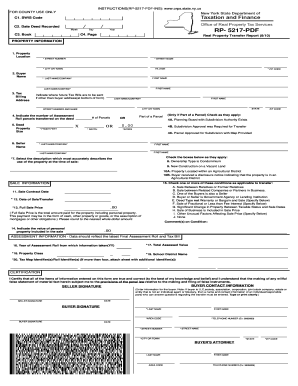

The NY DTF RP-5217-PDF form is essential for reporting real property transfers in New York. Completing this form online ensures accuracy and efficiency, simplifying the filing process for all users.

Follow the steps to successfully complete the NY DTF RP-5217-PDF form online.

- Press the ‘Get Form’ button to access the NY DTF RP-5217-PDF and open it in your preferred online editor.

- Begin filling out the property information section. Provide the property location by entering the street number, street name, city or town, and zip code.

- Next, enter the buyer's information, including the buyer's first and last name or company name.

- Indicate the tax billing address if it differs from the buyer's address.

- Specify the number of assessment roll parcels being transferred on the deed.

- Complete the seller's name section with the seller's first and last name or company name.

- Fill out the deed property size, including depth and front feet, where applicable.

- Select the appropriate property description that matches its use at the time of sale.

- In the sale information section, check any relevant conditions impacting the transfer.

- Provide the sale contract date and date of sale or transfer.

- Enter the full sale price, rounding to the nearest dollar, and include personal property value if applicable.

- Complete the assessment information section with the year of the assessment roll, property class, total assessed value, and school district name.

- Enter tax map identifiers if required.

- Read and complete the certification section to verify the accuracy of the information provided.

- Finally, ensure all buyer and seller signatures are affixed, including contact information and attorney details if applicable.

Complete your forms online for a streamlined filing experience.

To transfer a property title to a family member in New York, start by drafting a formal deed that specifies the new owner. You will also need to fill out the NY DTF RP-5217-PDF form to report the change to the city. Filing these documents with the appropriate local authority is crucial for the transfer to be legally recognized. Consider using uslegalforms for reliable templates and clear instructions to make this process straightforward.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.