Get Ny Dtf Rp-425 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF RP-425 online

How to fill out and sign NY DTF RP-425 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans are inclined to handle their own income tax filings and, additionally, to fill out forms digitally.

The US Legal Forms online service makes the process of preparing the NY DTF RP-425 straightforward and convenient.

Ensure that you have accurately completed and submitted the NY DTF RP-425 by the deadline. Consider any relevant timeframes. Providing incorrect information on your financial documents can lead to heavy penalties and complications with your yearly tax return. Utilize only certified templates with US Legal Forms!

- Examine the PDF template in the editor.

- Review the designated fillable fields. This is where you will enter your information.

- Select the option to choose if you encounter the checkboxes.

- Navigate to the Text icon along with other advanced features to manually modify the NY DTF RP-425.

- Verify all the details before proceeding with signing.

- Create your personalized eSignature using a keyboard, digital camera, touchpad, mouse, or mobile device.

- Authenticate your PDF form online and specify the date.

- Click on Done to continue.

- Save or send the document to the intended recipient.

How to Alter Get NY DTF RP-425 2012: Personalize forms on the web

Your swiftly adjustable and modifiable Get NY DTF RP-425 2012 template is within reach.

Do you delay finishing Get NY DTF RP-425 2012 because you simply don't know where to begin and how to move forward? We empathize with your situation and have an excellent solution for you that has nothing to do with battling your procrastination!

Our online inventory of ready-to-apply templates enables you to filter through and select from thousands of fillable forms designed for diverse purposes and scenarios. However, acquiring the file is merely the first step.

We provide you with all the essential features to complete, sign, and alter the document of your choice without departing from our website.

Emphasize, redact, and amend the existing text.

Multiple options for safeguarding your documents.

A variety of delivery methods for smoother sharing and dispatching of files. Adherence to eSignature regulations governing the deployment of eSignature in online transactions. With our professional choice, your finalized documents will nearly always be legally binding and entirely encrypted. We assure the protection of your most sensitive information. Acquire everything required to create a professionally appealing Get NY DTF RP-425 2012. Make the right decision and try our system today!

- Simply open the document in the editor.

- Review the wording of Get NY DTF RP-425 2012 and verify if it meets your needs.

- Start altering the template by utilizing the annotation tools to enhance the organization and neatness of your form.

- Incorporate checkmarks, circles, arrows, and lines.

- If the document is meant for additional users as well, you can introduce fillable fields and distribute them for others to complete.

- Once you finish adjusting the template, you can obtain the document in any available format or choose any sharing or delivery methods.

- To summarize, alongside Get NY DTF RP-425 2012, you will receive:

- A powerful suite of editing and annotation functionalities.

- An integrated legally-binding eSignature option.

- The capability to generate documents from scratch or based on the pre-uploaded template.

- Compatibility with various platforms and devices for enhanced convenience.

Get form

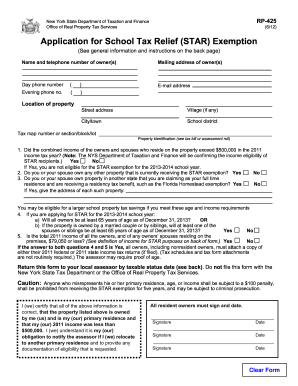

You can verify your registration for the NYS Star program by contacting the New York State Department of Taxation and Finance directly or by using their online services. If you have submitted the NY DTF RP-425 form, you should receive confirmation of your registration status. It's essential to keep track of your registration to ensure you benefit from the homeowner advantages available through the program. Regular updates from the department will also help you stay informed.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.