Get Ny Dtf Pt-101.1 2006-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF PT-101.1 online

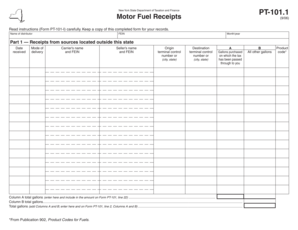

The NY DTF PT-101.1 form is essential for reporting motor fuel receipts in New York State. This guide provides clear instructions for completing the form online, ensuring users can efficiently manage their tax obligations.

Follow the steps to fill out the NY DTF PT-101.1 online.

- Click ‘Get Form’ button to access the NY DTF PT-101.1 form, opening it in your preferred online editor.

- Enter your name and FEIN (Federal Employer Identification Number) at the top of the form. Include the month and year for which you are reporting motor fuel receipts.

- In the first section, titled 'Receipts from sources located outside this state,' fill in the date received, mode of delivery, carrier’s name and FEIN, seller’s name and FEIN, and terminal control number for each transaction.

- For each row, input the gallons purchased on which the tax has been passed through to you under Column A, and enter all other gallons under Column B.

- Calculate the total gallons for Column A and indicate this number at the designated space. Ensure to include this total in the amount on Form PT-101, line 22.

- Add the totals from Columns A and B, and write this sum at the bottom of the section. This total will be used on Form PT-101, line 2, Columns A and B.

- Repeat steps 3 to 6 for the second section, titled 'Receipts from sources located within this state,' inputting data as required.

- Review all entries for accuracy before proceeding. Once completed, you may save changes, download, print, or share the form as needed.

Complete your form today and submit it online to stay compliant with New York tax regulations.

The fuel tax in New York varies depending on the type of fuel and how it is used. For most diesel and gasoline, there is a per-gallon tax collected at the pump. It is important to stay informed about these taxes, especially if you own a business that uses fuel regularly. You can find detailed information on fuel taxes on the New York State Department of Taxation and Finance’s website. The NY DTF PT-101.1 form may also be relevant for businesses that want to understand their tax liabilities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.