Loading

Get Ny Dtf It-280 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-280 online

This guide provides clear and supportive instructions for filling out the NY DTF IT-280 form online. Whether you are a beginner or need a refresher, this step-by-step approach will help streamline the process.

Follow the steps to accurately complete your NY DTF IT-280 form

- Press the ‘Get Form’ button to access the NY DTF IT-280 form and open it for editing.

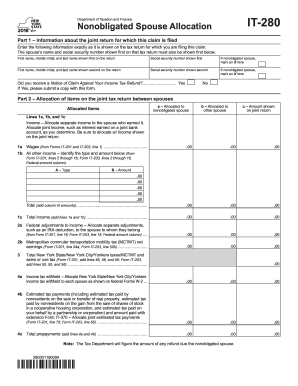

- In Part 1, provide information regarding the joint return. Fill out the names and social security numbers of both spouses as shown on the tax return. Ensure that the spouse marked as nonobligated is correctly indicated.

- If applicable, indicate whether you have received a Notice of Claim Against Your Income Tax Refund by selecting 'Yes' or 'No'. If 'Yes', attach a copy of the notice.

- Move to Part 2 to allocate items from the joint tax return. Allocate income, adjustments, and tax payments between the spouses. Carefully enter amounts in the designated sections, ensuring accuracy in the figures.

- In Part 3, sign and date the form. If applicable, have the paid preparer complete their section, including the NYTPRIN and PTIN, if required. Everyone should review the form for completeness and correctness.

- Once all sections are filled, save the changes. You can download, print, or share the completed form as needed.

Complete your forms online to ensure timely processing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Typically, employees working in specific areas of New York City are responsible for paying the NY transit tax. Employers may also collect this tax from employees’ wages. Knowing your obligations regarding the transit tax can streamline the process of filling out the NY DTF IT-280 and ensure that you meet all requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.