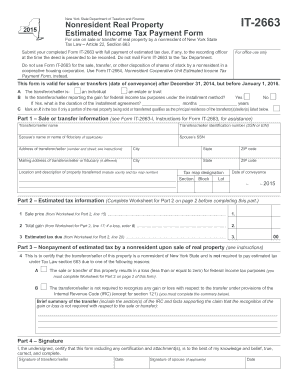

Get Ny Dtf It-2663 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF IT-2663 online

How to fill out and sign NY DTF IT-2663 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, a majority of Americans seem to favor handling their own income taxes and additionally, completing forms in electronic format.

The US Legal Forms online platform simplifies and facilitates the process of submitting the NY DTF IT-2663.

Make sure you have filled out and submitted the NY DTF IT-2663 accurately and on time. Review any relevant deadlines. Providing inaccurate information in your tax documents may lead to hefty penalties and complications with your yearly tax return. Ensure you utilize only approved templates with US Legal Forms!

- Launch the PDF blank in the editor.

- Observe the highlighted fillable fields. This is the area to enter your details.

- Choose the option if you locate the checkboxes.

- Explore the Text icon and other advanced tools to manually modify the NY DTF IT-2663.

- Verify each detail before proceeding to sign.

- Create your unique eSignature using a keyboard, digital camera, touchpad, mouse, or smartphone.

- Authorize your document online and specify the date.

- Click on Done to move ahead.

- Store or forward the document to the recipient.

How to modify Get NY DTF IT-2663 2015: personalize forms online

Utilize our comprehensive online document editor while filling out your forms. Complete the Get NY DTF IT-2663 2015, focus on the key aspects, and effortlessly make any required modifications to its content.

Creating documents digitally is not only efficient but also allows you to adjust the template according to your preferences. If you are about to handle the Get NY DTF IT-2663 2015, think about finishing it with our broad online editing capabilities. Whether you make a mistake or input the required details into the incorrect field, you can promptly correct the document without needing to restart it from scratch as with traditional filling.

Furthermore, you can highlight the crucial information in your document by using color coding, underlining, or encircling them.

Our robust online solutions are the easiest method to fill out and adjust Get NY DTF IT-2663 2015 according to your needs. Use it to handle personal or corporate paperwork from anywhere. Access it in a browser, make necessary revisions in your documents, and revisit them anytime later - all will be securely stored in the cloud.

- Access the file in the editor.

- Enter the required information in the empty fields using Text, Check, and Cross tools.

- Follow the navigation of the form to ensure no mandatory fields are overlooked.

- Encircle some of the important details and include a URL if necessary.

- Utilize the Highlight or Line features to mark the most significant parts of the content.

- Select colors and thickness for these lines to enhance the professional appearance of your form.

- Remove or blackout the information you wish to keep hidden from others.

- Swap out segments with errors and type in the correct text.

- Complete changes with the Done button as soon as you confirm everything is accurate in the form.

Get form

NYS DTF tax payment refers to any payment made to the New York State Department of Taxation and Finance for state taxes, including sales and income taxes. Taxpayers must ensure these payments are made on time to avoid penalties. Utilizing resources like the US Legal Forms platform can help you complete required forms like the NY DTF IT-2663 accurately and ensure timely tax payments.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.