Loading

Get Ny Dtf It-201-x 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

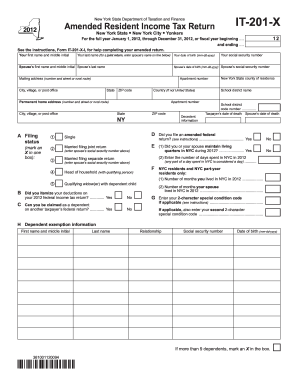

How to fill out the NY DTF IT-201-X online

Filling out the NY DTF IT-201-X form can be straightforward with the right guidance. This guide provides clear, step-by-step instructions to help you complete your amended resident income tax return for New York State.

Follow the steps to effectively fill out your form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document management system.

- Begin filling out your information. Provide your first name, middle initial, last name, and date of birth. If filing jointly, include your spouse's details in the designated areas.

- Enter your mailing address including the apartment number, city, state, ZIP code, and country if applicable. Ensure accuracy as this affects where your correspondence will be sent.

- Input your social security number along with your spouse’s social security number if filing jointly. This is crucial for identification purposes.

- Indicate your filing status by selecting one of the options provided. Mark the box that corresponds to whether you are single, married filing jointly, or another status.

- Complete the income section on the form. Report your wages, salaries, and any other sources of income as outlined on the form. Only whole dollar amounts are accepted.

- If you are claiming deductions or credits, ensure to fill in the appropriate sections related to them. Carefully follow the instructions provided for determining itemized versus standard deductions.

- Review the tax computation section to ensure all calculations are accurate based on your reported income. Pay attention to any NYC or Yonkers resident taxes if applicable.

- Check the payment and refundable credits section if you have any credits to claim. Record any state or local taxes withheld.

- Once all fields are completed, save your changes. You have the option to download, print, or share the completed form as needed.

Take the next step and start filling out your NY DTF IT-201-X online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The NY IT-201 is the standard resident income tax return form, while the IT-201-X is the form used to amend a previously filed IT-201. The IT-201-X allows you to correct errors or claim additional deductions after your initial filing. Utilizing the correct form ensures that your tax situation is accurately reflected with the New York Department of Taxation and Finance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.