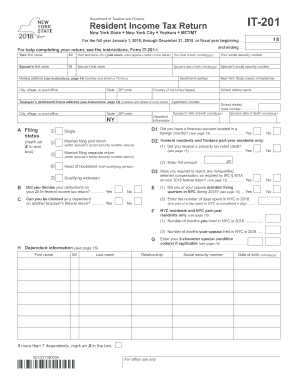

Get Ny Dtf It-201 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF IT-201 online

How to fill out and sign NY DTF IT-201 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans opt to handle their own tax returns and, indeed, to complete forms digitally.

The US Legal Forms online service simplifies the task of submitting the NY DTF IT-201, making it straightforward and stress-free.

Ensure that you have accurately completed and submitted the NY DTF IT-201 on time. Review any relevant deadlines. Providing incorrect information on your tax filings can lead to significant penalties and issues with your annual tax return. Utilize only professional templates with US Legal Forms!

- Access the PDF template in the editor.

- Observe the designated fillable fields. This is where you will enter your information.

- Choose the option to select if you notice the checkboxes.

- Explore the Text tool as well as additional advanced features to manually edit the NY DTF IT-201.

- Verify all the information prior to signing.

- Create your personalized eSignature using a keypad, digital camera, touchpad, mouse, or smartphone.

- Authorize your web-template electronically and enter the date.

- Press Done to continue.

- Download or send the document to the designated recipient.

How to adjust Get NY DTF IT-201 2018: tailor forms online

Select a trustworthy document editing solution you can depend on. Alter, execute, and verify Get NY DTF IT-201 2018 securely online.

Often, revising forms, such as Get NY DTF IT-201 2018, can be troublesome, especially if you received them in a digital format but lack specialized software. While there are various workarounds to bypass this issue, you risk producing a form that fails to meet submission standards. Using a printer and scanner is also not a viable alternative as it consumes time and resources.

We provide a more straightforward and efficient method for modifying documents. Our extensive collection of document templates is simple to alter and certify, making them fillable for others. Our platform goes far beyond just a template collection. One of the greatest advantages of using our services is that you can edit Get NY DTF IT-201 2018 directly on our site.

Being a web-based platform, it eliminates the need to download any software. Additionally, not all corporate policies allow you to install it on your work laptop. Here’s how you can seamlessly and securely manage your paperwork with our solution.

Forget about paper and other ineffective methods of altering your Get NY DTF IT-201 2018 or additional forms. Opt for our tool instead that merges one of the most comprehensive libraries of customizable forms with robust document editing services. It's straightforward and secure and can save you significant time! Don't just take our word for it, give it a try!

- Click the Get Form > and you’ll be promptly directed to our editor.

- After it opens, you can start the editing process.

- Choose checkmarks or circles, lines, arrows and crosses, and other options to annotate your document.

- Select the date field to add a specific date to your template.

- Insert text boxes, graphics, notes, and more to enhance the content.

- Utilize the fillable fields feature on the right to create fillable {fields.

- Choose Sign from the top toolbar to generate and craft your legally-binding signature.

- Click DONE to save, print, share, or download the final {file.

Get form

Absolutely, you can file an amended NYS 45 online through the New York State Department of Taxation and Finance. This online filing option allows for a quicker resolution of any discrepancies in your records. Remember to align any changes with your NY DTF IT-201 to maintain accurate filings.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.