Loading

Get Ny Dtf It-2 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-2 online

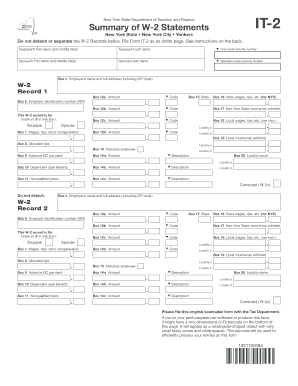

Filling out the NY DTF IT-2 form is essential for reporting your W-2 statements to the New York State Department of Taxation and Finance. This guide provides a step-by-step approach to help users accurately complete the form online.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to retrieve the NY DTF IT-2 form and access it for filling out.

- Enter the taxpayer’s first name, middle initial, last name, and social security number in the designated fields.

- If applicable, enter the spouse’s first name, middle initial, last name, and social security number.

- Input the employer's name and full address, including the ZIP code, in Box c.

- For each W-2 Record, begin with Box 1 and enter the federal wages, tips, and other compensation as indicated on your federal Form W-2.

- Fill out Boxes 12a through 12d with the corresponding amounts and codes from your W-2, if applicable.

- Complete Box 13, marking an X in the Statutory employee box if applicable based on the federal Form W-2.

- In Boxes 14a to 14c, input any relevant amounts and descriptions shown in box 14 of your federal Form W-2.

- If your federal Form W-2 shows New York State, New York City, or Yonkers wages or withholding, complete Boxes 15 to 20 with the appropriate information.

- Double-check all entries for accuracy. Once completed, you can save changes, download, print, or share the form as needed.

Complete your documents online to ensure timely filing and compliance with tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can obtain NY tax forms from the New York State Department of Taxation and Finance website. Additionally, many local libraries and post offices provide physical copies of these forms. For convenience, using online resources can help you efficiently access and complete your necessary forms, including the NY DTF IT-2.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.