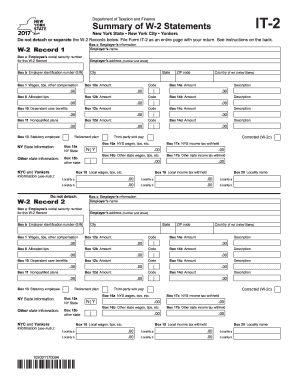

Get Ny Dtf It-2 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF IT-2 online

How to fill out and sign NY DTF IT-2 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans are inclined to submit their own tax returns and also to complete forms electronically. The US Legal Forms web platform simplifies the process of e-filing the NY DTF IT-2, making it efficient and user-friendly. Now, it should take no longer than 30 minutes, and you can accomplish it from virtually anywhere.

The optimal method to obtain the NY DTF IT-2 swiftly and effortlessly:

Ensure that you have accurately completed and delivered the NY DTF IT-2 by the deadline. Be mindful of any relevant timeframes. Providing incorrect information in your tax documents could lead to significant penalties and complications with your annual income tax return. Always utilize professional templates from US Legal Forms!

- Launch the PDF template within the editor.

- Review the designated fillable fields where you can enter your information.

- Select the option to indicate your choice if checkboxes are visible.

- Navigate to the Text tool and other enhanced functionalities to manually modify the NY DTF IT-2.

- Confirm all information before proceeding to sign.

- Create your personalized eSignature using a keypad, camera, touchpad, mouse, or mobile device.

- Authenticate your template online and specify the exact date.

- Click on Done to proceed.

- Download or send the document to the recipient.

How to modify Get NY DTF IT-2 2017: personalize documents online

Experience a hassle-free and paperless approach to working with Get NY DTF IT-2 2017. Utilize our trustworthy online platform and save significant time.

Creating every document, including Get NY DTF IT-2 2017, from the beginning requires excessive effort, so having a reliable solution of pre-crafted document templates can enhance your productivity.

Yet, collaborating with them can be challenging, especially with PDF files. Fortunately, our extensive library features a built-in editor that allows you to seamlessly fill out and modify Get NY DTF IT-2 2017 without leaving our website, preventing you from squandering valuable time on your paperwork. Here’s what you can accomplish with your document using our service:

Whether you need to finalize an editable Get NY DTF IT-2 2017 or any other template offered in our catalog, you’re well-equipped with our online document editor. It’s straightforward and secure and doesn’t require a specific technical background. Our web-based tool is crafted to handle nearly everything you can imagine regarding document editing and completion.

Stop relying on conventional methods for managing your forms. Opt for a professional solution to simplify your tasks and reduce paper dependency.

- Step 1. Locate the necessary document on our site.

- Step 2. Select Get Form to access it in the editor.

- Step 3. Utilize professional editing tools that enable you to add, delete, comment on, and highlight or obscure text.

- Step 4. Create and attach a legally-recognized signature to your document by using the sign option from the top toolbar.

- Step 5. If the template format doesn’t appear as desired, employ the options on the right to delete, insert, and rearrange pages.

- Step 6. Add fillable fields so others can be invited to finish the template (if necessary).

- Step 7. Distribute or send the document, print it, or select the format in which you wish to receive the file.

Get form

NYC 2S is a tax form intended for certain New York City taxpayers, particularly those who aim for a simplified filing process. This form is designed for specific income earners, allowing them to report their income accurately while taking advantage of deductions. If you qualify for NYC 2S, it can save you time during tax season. Consider using uslegalforms for essential guidance regarding this form and its requirements.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.