Get Ny Dtf Ft-943 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF FT-943 online

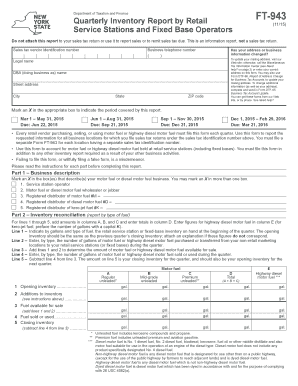

Filling out the NY DTF FT-943 form online can help you efficiently report your quarterly inventory at retail service stations and fixed base operators. This guide provides clear, step-by-step instructions to assist you in completing the form accurately.

Follow the steps to complete the NY DTF FT-943 online.

- Click ‘Get Form’ button to obtain the form and access it in the online editor.

- Enter your sales tax vendor identification number and legal name in the designated fields. Include your business telephone number.

- If your address or business information has changed, indicate this on the form or use Form DTF-96 to update your mailing address.

- Mark an X in the appropriate box to indicate the reporting period for which you are submitting this inventory report.

- In Part 1, business description, check the box or boxes that describe your motor fuel or diesel motor fuel operations.

- In Part 2, inventory reconciliation, provide the beginning inventory, additions to inventory, amount available for sale, fuel sold or used, and calculate your closing inventory by completing the relevant lines.

- In Part 3, summary of motor fuel and diesel motor fuel purchases, enter details about your fuel purchases including supplier names, identification numbers, addresses, type of fuel, and total gallons purchased.

- Complete the authorization section by providing the signature of an authorized person along with their title and contact information.

- If applicable, have the individual preparing the return sign in the paid preparer section, providing their information including PTIN or SSN.

- Review your completed form for accuracy, save your changes, and then proceed to download, print, or share the form as needed.

Ensure accurate reporting by completing your NY DTF FT-943 online today.

Get form

Use tax in New York is imposed on goods purchased outside the state but used within its borders without being subjected to sales tax. This tax aims to ensure fairness in taxation between in-state and out-of-state sellers. Businesses must accurately report any use tax owed on their NY DTF FT-943 to avoid any compliance issues. By understanding your use tax obligations, you can confidently navigate your tax responsibilities.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.