Loading

Get Ny Dtf Ct-300 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF CT-300 online

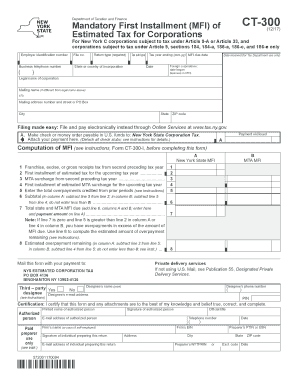

The NY DTF CT-300 is a mandatory first installment form for estimated tax for corporations in New York. This guide will provide you with clear and supportive instructions on how to complete the form online, ensuring accuracy and compliance with state requirements.

Follow the steps to complete the NY DTF CT-300 online successfully.

- Begin by clicking the ‘Get Form’ button to access the NY DTF CT-300 form and open it in your preferred online editor.

- Enter your employer identification number (EIN) in the designated field. This is essential for identifying your corporation.

- Fill in your business telephone number to allow for easy contact regarding your submission.

- Indicate the state or country of incorporation for your corporation.

- Choose the return type applicable to your corporation from the options provided.

- Select the tax sub-type and enter the tax year ending date in the specified format (mm-yy).

- Input the mandatory first installment due date as required for your submission.

- Complete the computation of the MFI by accurately entering the franchise, excise, or gross receipts tax from the second preceding tax year.

- Proceed to enter the first installment of the estimated tax for the upcoming tax year, ensuring that figures are accurate.

- Document the MTA surcharge from the second preceding tax year and then the first installment of the estimated MTA surcharge for the upcoming tax year.

- Input any total overpayments credited from prior periods as applicable.

- Calculate the subtotal by subtracting overpayments from the totals you've entered in previous steps.

- Add the lines together to find the total state and MTA MFI due, which will be used to determine your payment amount.

- If applicable, compute any estimated overpayment remaining as directed in the instructions.

- Review all entries for accuracy and completeness before finalizing your form.

- Once all information is correct, proceed to save changes, download, print, or share the form as necessary.

Complete your NY DTF CT-300 online today to ensure timely compliance with your tax obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

DTF stands for the Department of Taxation and Finance, the agency responsible for administering tax laws in New York State. This department manages various aspects of tax collection, including income, sales, and property taxes. Understanding what DTF stands for in taxes can help individuals and businesses navigate the New York tax system more effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.