Get Ca Ftb 3885 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3885 online

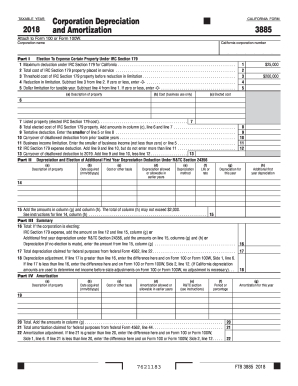

The CA FTB 3885 form is essential for California corporations wishing to claim depreciation and amortization deductions. This guide provides a clear, step-by-step process on how to fill out the form online, ensuring a smooth completion and submission.

Follow the steps to successfully complete your CA FTB 3885 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I, titled Election to Expense Certain Property Under IRC Section 179. Here, you will enter the maximum deduction for the year and the total cost of qualifying Section 179 property placed in service.

- Complete lines 3 and 4 to determine any reduction in your deduction limitation. This involves entering the threshold cost of the property and subtracting that from your total cost.

- For line 5, calculate the dollar limitation for the taxable year by subtracting the reduction from the maximum deduction.

- In columns (a), (b), and (c), provide descriptions of the property, costs associated (for business use only), and the elected costs for each item.

- Proceed to Part II, where you will fill out information related to depreciation and any additional first-year depreciation deductions for assets acquired.

- Follow through the remaining sections of the form, completing Part III for summary and outcomes of your deductions, as well as Part IV for any amortization requirements.

- After ensuring all data is accurate, save changes, download the completed form, or print it for submission.

Complete your CA FTB 3885 online today to ensure you maximize your tax benefits!

Get form

When completing the California withholding allowance certificate, begin by entering your personal information, including your social security number. Next, indicate the number of allowances you wish to claim based on your tax situation. Using this form can help ensure that the correct amount of taxes is withheld from your paycheck, aligning with your expectations when filing taxes, especially if you are referencing CA FTB 3885.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.