Get Ny Dtf Ct-3-m (formerly Ct-3m/4m) 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF CT-3-M (formerly CT-3M/4M) online

How to fill out and sign NY DTF CT-3-M (formerly CT-3M/4M) online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Today, a majority of Americans choose to handle their own income tax returns and, in fact, to complete forms digitally.

The US Legal Forms online service facilitates the process of electronic filing for the NY DTF CT-3-M (previously CT-3M/4M) straightforward and free of complications.

Ensure that you have accurately completed and submitted the NY DTF CT-3-M (previously CT-3M/4M) by the deadline. Consider any relevant timelines. Providing false information on your financial documents can result in severe penalties and complications with your annual tax filing. Be certain to use only valid templates from US Legal Forms!

- Open the PDF template in the editor.

- Observe the designated fillable fields where you can enter your information.

- Select the option if you see the checkboxes.

- Utilize the Text tool along with other advanced features to customize the NY DTF CT-3-M (previously CT-3M/4M) manually.

- Double-check all the information before proceeding to sign.

- Create your personalized eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your PDF form electronically and specify the date.

- Click on Done to proceed.

- Store or send the document to the recipient.

How to modify Get NY DTF CT-3-M (previously CT-3M/4M) 2018: personalize forms online

Eliminate the clutter from your documentation process. Uncover the simplest way to locate, modify, and submit a Get NY DTF CT-3-M (previously CT-3M/4M) 2018.

The task of preparing Get NY DTF CT-3-M (previously CT-3M/4M) 2018 demands accuracy and focus, particularly from individuals who aren’t well acquainted with such responsibilities. It is vital to obtain an appropriate template and complete it with the correct details. With the ideal solution for managing documents, you can have all the necessary tools at your disposal. It is uncomplicated to enhance your editing experience without acquiring new capabilities. Find the suitable sample of Get NY DTF CT-3-M (previously CT-3M/4M) 2018 and fill it out immediately without toggling between your web pages. Explore additional tools to adjust your Get NY DTF CT-3-M (previously CT-3M/4M) 2018 form in the editing mode.

While on the Get NY DTF CT-3-M (previously CT-3M/4M) 2018 document, simply click the Get form button to initiate editing. Input your information directly into the form, as all the crucial tools are right here. The template is pre-formulated, so the user’s effort is minimal. Utilize the interactive fillable fields in the editor to effortlessly finish your documentation. Just click on the form and transition to the editor mode right away. Complete the interactive field, and your file is prepared.

Explore further tools to personalize your form: Place additional text around the document if necessary. Use the Text and Text Box tools to add text in a separate box. Include pre-designed graphical elements like Circle, Cross, and Check with their respective tools. If necessary, capture or upload images to the document with the Image tool. If you need to sketch something in the document, utilize Line, Arrow, and Draw tools. Utilize the Highlight, Erase, and Blackout tools to modify the text in the document. If you need to insert comments to specific sections of the document, click on the Sticky tool and place a note where desired.

- Sometimes, a minor mistake can spoil the entire form when one fills it out manually.

- Forget about errors in your documentation.

- Find the templates you require in seconds and complete them digitally through an intelligent editing solution.

Get form

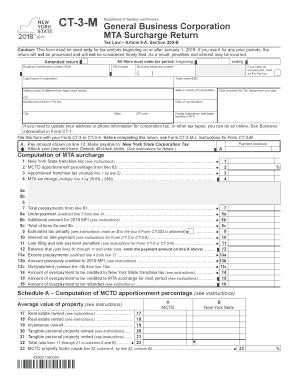

The form CT 3m, commonly referred to as the NY DTF CT-3-M (formerly CT-3M/4M), is utilized by S corporations to report their income, deductions, and tax liabilities in New York State. This form consolidates crucial tax information, ensuring that businesses properly comply with state regulations. To navigate this process effectively, consider using uslegalforms for streamlined support.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.