Loading

Get Ny Dtf Ct-3 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF CT-3 online

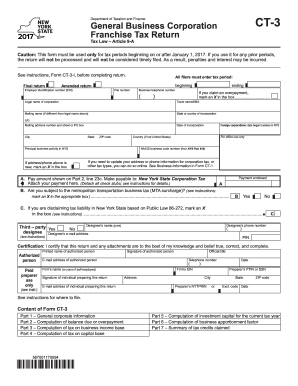

Filling out the NY DTF CT-3 form online can be a straightforward process when approached methodically. This guide provides comprehensive steps to assist users in accurately completing their franchise tax return for general business corporations.

Follow the steps to fill out the NY DTF CT-3 form online.

- Click the ‘Get Form’ button to obtain the CT-3 form and open it in your online editing tool.

- Begin filling in the required fields with your corporate information. Enter the tax period, employer identification number (EIN), and the legal name of the corporation in the designated sections.

- Indicate whether this is a final return or an amended return by marking the appropriate box.

- If applicable, provide details about any subsidiaries incorporated outside New York State by marking the designated checkbox.

- Fill in the mailing name (if it differs from the legal name), business telephone number, and address details, ensuring all information is accurate.

- Complete any additional sections related to the business’s corporate activities, including any claims for overpayment and relevant tax questions regarding business conducted within the Metropolitan Commuter Transportation District.

- Proceed to the computation sections, entering information related to net income and capital base, based on your financial records.

- Finish by reviewing all entered information for accuracy and completeness before saving your changes.

- Once your form is complete, you can download, print, or share the finalized CT-3 form as required.

Complete your NY DTF CT-3 form online today and ensure your business adheres to state tax obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

CT-3.3 is a form used by New York corporations to report certain credits and deductions related to their income tax. This form is specifically meant for particular situations where entities can benefit from specific tax adjustments. It helps businesses ensure they are taking advantage of available tax benefits. If you need help navigating these forms, uslegalforms can guide you.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.