Loading

Get Nv Txr-02.01 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NV TXR-02.01 online

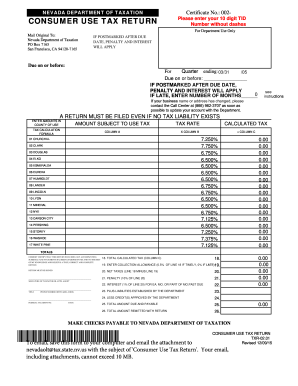

The NV TXR-02.01 is an essential document used for reporting consumer use tax in Nevada. This guide provides clear, step-by-step instructions aimed at simplifying the process of filling out this form online.

Follow the steps to complete the NV TXR-02.01 accurately

- Click 'Get Form' button to obtain the form and open it for completion.

- Enter your 10-digit TID number in the designated field. Ensure no dashes are included.

- Fill in the due date for your tax return based on the quarter ending date. This is critical to avoid penalties.

- If applicable, indicate the number of months the return is late, which may affect penalties.

- List the amount subject to use tax by entering the total purchases in the appropriate county of use line.

- Calculate the tax by multiplying the amounts in Column A by the tax rates provided in Column B. Enter the result in Column C.

- Total the amounts from Column A and enter the value in the 'TOTALS' section.

- Complete lines 18 through 26 by following the provided calculations, including penalties and interests if applicable.

- Provide your signature as the taxpayer or authorized agent, including your title and phone number.

- Review all entered information for accuracy. Once satisfied, save the changes, then download, print, or share the completed form.

Complete your NV TXR-02.01 online today to ensure timely filing and compliance.

If your business has payroll exceeding the established threshold, you are subject to Nevada's modified business tax. This tax affects various business structures including corporations and partnerships. As part of your tax compliance strategy, familiarize yourself with NV TXR-02.01 to ensure you meet all requirements. Proper planning can help mitigate any potential tax liabilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.