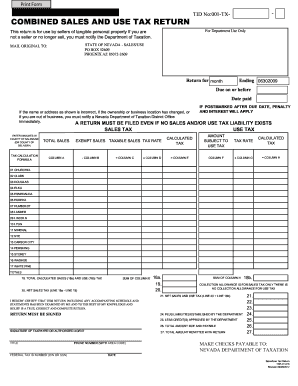

Get Nv Txr-01.01b 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NV TXR-01.01b online

How to fill out and sign NV TXR-01.01b online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans choose to complete their own income tax filings and, additionally, to submit reports digitally. The US Legal Forms online platform simplifies the process of submitting the NV TXR-01.01b, making it straightforward and free from stress. It now takes no more than thirty minutes, and you can accomplish it from virtually anywhere.

How to file NV TXR-01.01b quickly and effortlessly:

Ensure you have accurately completed and submitted the NV TXR-01.01b on time. Consider any relevant deadlines. Providing incorrect information in your financial reports could lead to substantial penalties and complications with your annual tax return. Always utilize professional templates with US Legal Forms!

- Access the blank PDF in the editor.

- Refer to the highlighted areas where you can enter your information.

- Select the option when you view the checkboxes.

- Utilize the Text tool and other advanced functionalities to manually edit the NV TXR-01.01b.

- Review all details before you continue with signing.

- Create your custom eSignature using a keypad, camera, touchpad, mouse, or mobile device.

- Certify your document electronically and indicate the date.

- Click Done to proceed.

- Download or send the document to the recipient.

How to revise Get NV TXR-01.01b 2012: personalize forms online

Place the appropriate document management features at your disposal. Administer Get NV TXR-01.01b 2012 with our reliable service that includes editing and eSignature tools.

If you wish to manage and sign Get NV TXR-01.01b 2012 online seamlessly, then our web-based solution is the perfect answer. We offer an extensive library of template-based forms that you can adjust and complete online. Furthermore, there is no need to print the document or utilize external services to render it fillable. All essential functionalities will be readily accessible once you open the file in the editor.

Let’s explore our online editing features and their primary functionalities. The editor comes with an intuitive interface, so it won’t take long to learn how to navigate it. We will examine three key areas that enable you to:

In addition to the functionalities stated above, you can secure your file with a password, add a watermark, convert the file to your desired format, and much more.

Our editor simplifies modifying and certifying the Get NV TXR-01.01b 2012. It empowers you to essentially do everything regarding document management. Additionally, we always guarantee that your editing experience is secure and adheres to key regulatory standards. All these elements enhance the use of our solution.

Obtain Get NV TXR-01.01b 2012, implement the necessary edits and modifications, and receive it in your desired file format. Give it a try today!

- Revise and comment on the template

- The upper toolbar includes features that assist you in emphasizing and concealing text, omitting images and graphic elements (lines, arrows, checkmarks, etc.), signing, initialing, dating the document, and more.

- Organize your documents

- Utilize the left toolbar if you wish to rearrange the document or/and remove pages.

- Prepare them for distribution

- If you aim to create a fillable template for others and circulate it, you can apply the tools on the right and insert various fillable fields, signature and date, text box, etc.

You can apply for a Nevada modified business tax ID through the Nevada Department of Taxation. This process typically requires your business information and may involve online submission. Being informed about NV TXR-01.01b can ensure you complete the application correctly. Consider using uslegalforms for streamlined access to necessary forms and expert advice.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.