Loading

Get Nv Txr-01.01a 2006-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NV TXR-01.01a online

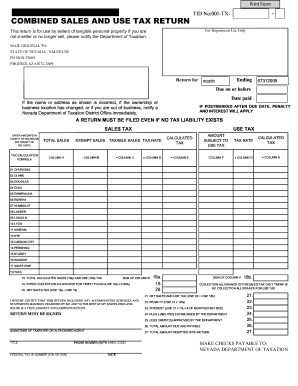

The NV TXR-01.01a form is essential for sellers of tangible personal property in Nevada to report sales and use tax. Filling it out accurately ensures compliance and avoids potential penalties. This guide provides clear, step-by-step instructions to help users complete the form online with confidence.

Follow the steps to complete the NV TXR-01.01a form online effectively.

- Click the ‘Get Form’ button to access the NV TXR-01.01a form and open it in your preferred editor.

- Enter your TID number in the designated field. This number is assigned to your business by the Nevada Department of Taxation.

- Indicate the return month by providing the appropriate date of the sales being reported.

- If your name or address is incorrect, update it in the specified fields.

- Complete the sales and use tax calculations by entering amounts in Column A (Total Sales) for every applicable county.

- In Column B, input the amounts for exempt sales, ensuring to detail the reasons those sales are exempt.

- Calculate the taxable sales by subtracting Column B from Column A; enter this amount in Column C.

- Multiply the Taxable Sales from Column C by the tax rate for your county; enter the result in Column E.

- For Column F (Amount Subject to Use Tax), report the purchase price of items used rather than resold.

- Calculate the Calculated Tax for the use tax by multiplying the amount in Column F by the tax rate in Column G; enter this in Column H.

- Sum up the calculated sales tax from Column E and the use tax from Column H, entering these totals in Lines 18a and 18b respectively.

- Factor in any Collection Allowance if applicable by using the instructions provided, then complete Lines 20 and 21.

- Address any penalties and interest in Lines 22 and 23 if the return is submitted late.

- Finally, complete and sign the return, providing your title, Federal Tax ID number, phone number, and the date.

- Once all fields are completed, save your changes, and choose to download, print, or share the filled form.

Complete your NV TXR-01.01a form online today to ensure your sales tax obligations are met.

Amending a modified business tax return in Nevada starts with completing the correct amendment form provided by the Department of Taxation. Clearly indicate the changes made and ensure you follow the filing guidelines set by the NV TXR-01.01a. For a seamless process, consider using services like UsLegalForms to simplify your amendment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.