Loading

Get Nv Txr-01.01 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NV TXR-01.01 online

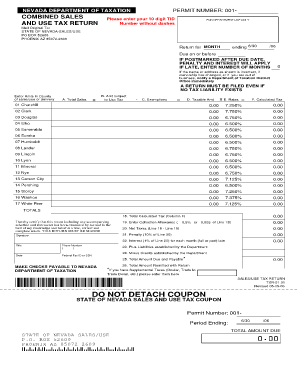

The NV TXR-01.01 is an essential form for reporting combined sales and use taxes to the Nevada Department of Taxation. This guide will provide you with step-by-step instructions on how to accurately fill out the form online, ensuring compliance with tax regulations.

Follow the steps to successfully complete the NV TXR-01.01 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your 10-digit Tax Identification Number (TID) without dashes in the designated field.

- Check the 'Return for Month' section and enter the specific month and year for your tax return.

- If any information like your name or address is incorrect, or if ownership has changed, notify the Department of Taxation immediately.

- Indicate whether you have a tax liability by entering the number of months late, if applicable.

- In the 'Combined Sales/Use Tax Return' section, fill in Column A with the total sales amount for each county related to your Nevada business.

- Proceed to Column B and enter the amount subject to use tax for purchases made without Nevada tax.

- Input any exemptions in Column C for sales that are not subject to tax, such as sales to government entities or non-profit organizations.

- Calculate the taxable amount in Column D by adding Column A and B, then subtracting Column C. This amount may auto-populate if you are using an electronic version.

- In Column E, review applicable tax rates for each county and then multiply the taxable amount (Column D) by the tax rate to find the calculated tax, which should be entered in Column F.

- At line 18, enter the total calculated tax from Column F for the combined sales/use tax return.

- For line 19, calculate the collection allowance as 0.5% of line 18, but enter 0 if not postmarked by the due date.

- For line 20, subtract line 19 from line 18 to find the net taxes due.

- If taxes are being reported late, calculate line 21 for penalties and line 22 for interest based on the number of months late.

- For lines 23 and 24, include any previous liabilities or credits recognized by the Department of Taxation.

- Add relevant amounts for line 25 to determine the total amount due and payable, including any supplemental taxes.

- Finally, enter the total amount to be remitted with the return on line 26.

- Make sure to complete the signature section, including your title and phone number, before submission.

Complete your NV TXR-01.01 form online today to ensure timely and accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filling out the Employee's Withholding Allowance Certificate requires you to state your personal information and your chosen filing status. Factor in your total number of allowances based on your expected tax situation. Use the NV TXR-01.01 guidelines for clarity, as they can assist you in identifying the right amount to withhold and comply with regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.