Get Nv Txr-01.01 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NV TXR-01.01 online

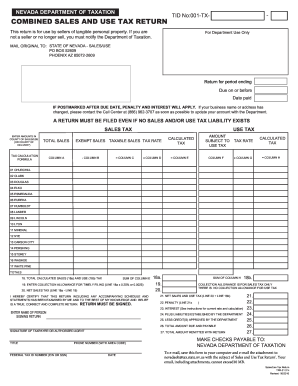

The NV TXR-01.01 form is essential for sellers of tangible personal property in Nevada, helping to ensure proper reporting of sales and use tax. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently, even without prior legal experience.

Follow the steps to effectively complete the NV TXR-01.01 online.

- Press the ‘Get Form’ button to access the NV TXR-01.01 form and open it in the online editor.

- Enter your TID number in the designated field at the top of the form. This is crucial for identifying your business with the Nevada Department of Taxation.

- Fill in the return period ending date and the due date for the form submission to ensure compliance.

- For sales tax, in Column A, report the total sales amount for the designated county excluding the sales tax collected.

- In Column B, list the exempt sales that are not subject to tax. Be sure to include the necessary details as outlined in the instructions.

- Calculate your taxable sales by subtracting the exempt sales (Column B) from the total sales (Column A) and enter the result in Column C.

- Using the tax rate provided, multiply the taxable sales in Column C by the tax rate to calculate the tax due. Enter this amount in Column E.

- If applicable, enter the amount subject to use tax in Column F, detailing any purchases on which Nevada tax was not paid.

- Calculate the tax due on the use tax by multiplying the amount subject to use tax (Column F) by the appropriate tax rate. Enter this in Column H.

- Summarize the total calculated sales tax (Line 18a) and use tax (Line 18b) and enter these amounts in the indicated lines.

- Complete any necessary calculations for allowances, net tax, penalties, and interest as outlined. Make sure to follow the calculations based on the provided instructions.

- If applicable, enter any prior liabilities and credits as specified and calculate the total amount due.

- Finish by completing the signature section, ensuring that the person signing the form is identified correctly, along with their title and contact information.

- Once all fields are filled, save any changes made, download the completed form, print it for mailing, or share it as needed.

Start filling out your NV TXR-01.01 form online today to ensure timely and accurate tax reporting.

Tax exempt purchases in Nevada generally include items bought by qualifying nonprofit organizations, government entities, and certain educational institutions. These qualifications can vary, so it is essential to understand the criteria established by NV TXR-01.01. Engaging with tax experts or platforms like uslegalforms can provide clarity on eligible purchases.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.