Loading

Get Nv Dot Tid 020-tx 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NV DoT TID 020-TX online

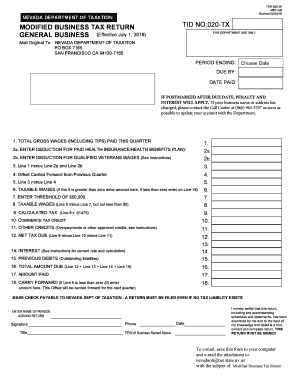

Filling out the NV DoT TID 020-TX form is essential for businesses in Nevada to report their modified business tax. This guide provides clear, step-by-step instructions to ensure that users can easily complete the form online, addressing each section and field for clarity.

Follow the steps to successfully complete the NV DoT TID 020-TX form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- In the 'Period Ending' section, choose the date that correctly reflects the end of the reporting quarter.

- Enter the total gross wages paid during the quarter in Line 1, including all tips received.

- In Line 2a, input the deduction for employer-paid health insurance or health benefits plan costs incurred during the quarter.

- Complete Line 2b by entering the deduction for qualified veteran wages, ensuring to attach required documentation.

- Subtract the deductions from Line 1 in Line 3 to find your adjusted net wages.

- If applicable, enter any offset carried forward from the previous quarter in Line 4. This reduces your taxable wage base.

- Calculate taxable wages in Line 5 by subtracting Line 4 from Line 3.

- Enter the threshold of $50,000 in Line 7 as mandated by legislation.

- In Line 8, calculate taxable wages by subtracting the threshold (Line 7) from Line 5. If this number is less than zero, do not enter an amount.

- Multiply the amount in Line 8 by 0.01475 in Line 9 to determine the calculated tax due.

- Complete Lines 10 and 11 by entering any commerce tax credits and other credits, as applicable.

- Calculate your net tax due in Line 12 by subtracting Lines 10 and 11 from Line 9.

- If applicable, calculate penalties for late payments in Line 13 by determining the number of days late and applying the appropriate percentage.

- Calculate any interest due in Line 14 by multiplying Line 12 by the specified interest rate for each month late.

- In Line 15, enter any previous debits established by the Department for prior quarters.

- Total all amounts due in Line 16 by adding Lines 12, 13, 14, and 15.

- Indicate the amount you are remitting in Line 17, and enter any carry-forward amounts in Line 18 if applicable.

- Review your entries for accuracy and completeness, ensuring documentation is attached where required. Save changes or download the form for printing.

Complete and submit your NV DoT TID 020-TX form online today for a streamlined filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

No, a state license number is not the same as a tax ID. A state license number is typically required for operating a business in Nevada legally, while a tax ID like the NV DoT TID 020-TX is specifically for tax reporting. Both numbers are essential but serve different purposes in your business operations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.