Get Nm Trd Rpd-41326 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NM TRD RPD-41326 online

How to fill out and sign NM TRD RPD-41326 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

In the present day, the majority of Americans seem to favor handling their own income taxes and, indeed, completing forms digitally.

The US Legal Forms online service streamlines the submission of the NM TRD RPD-41326, making it quick and easy.

Ensure you have accurately completed and submitted the NM TRD RPD-41326 on time. Review any relevant deadlines. Providing incorrect information on your tax documents can result in severe penalties and issues with your yearly tax filings. Only utilize professional templates available through US Legal Forms!

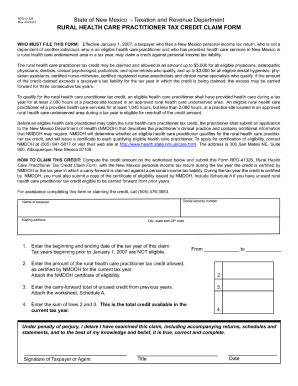

- Open the PDF document in the editor.

- Look at the marked fillable areas. This is where you can enter your details.

- Select the option you choose if checkboxes are present.

- Navigate to the Text icon and other advanced options to manually adjust the NM TRD RPD-41326.

- Confirm all the information before continuing to sign.

- Create your unique eSignature using a keyboard, webcam, touchpad, mouse, or smartphone.

- Authenticate your document electronically and indicate the date.

- Click Done to proceed.

- Save or send the document to the recipient.

How to modify Get NM TRD RPD-41326 2012: personalize forms online

Your quickly adjustable and customizable Get NM TRD RPD-41326 2012 template is easily accessible. Optimize our collection with a built-in web-based editor.

Do you delay creating Get NM TRD RPD-41326 2012 because you don’t know how to begin and how to proceed? We comprehend your situation and have a great resource for you that isn't related to overcoming your delays!

Our online library of ready-to-modify templates allows you to sift through and choose from thousands of editable forms designed for various purposes and contexts. However, acquiring the document is just the beginning. We offer you all the essential functions to complete, certify, and alter the form of your choice without leaving our site.

All you need to do is access the form in the editor. Review the wording of Get NM TRD RPD-41326 2012 and verify whether it meets your requirements. Begin customizing the form using the annotation tools to give your document a more structured and tidier appearance.

In summary, together with Get NM TRD RPD-41326 2012, you will receive:

Adherence to eSignature regulations governing the use of eSignature in online transactions.

With our fully-equipped option, your finished documents will always be legally binding and completely encrypted. We ensure the protection of your most sensitive data. Get everything you need to create a professional-looking Get NM TRD RPD-41326 2012. Make an informed decision and explore our system today!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, obscure, and correct the existing text.

- If the form is meant for additional users, you can incorporate fillable fields and distribute them for others to complete.

- After you finish adjusting the template, you can download the document in any available format or choose any sharing or delivery method.

- A comprehensive suite of editing and annotation utilities.

- An integrated legally-binding eSignature capability.

- The possibility to generate documents from scratch or based on the pre-designed template.

- Compatibility with multiple platforms and devices for enhanced convenience.

- Numerous options for securing your files.

- A variety of delivery methods for easier sharing and sending out documents.

Get form

Related links form

Many states require 1099 reporting, particularly those that have income taxes. Each state has its own regulations regarding the income threshold and types of payments that necessitate reporting. To ensure you meet your obligations and align with NM TRD RPD-41326, you may find it helpful to consult US Legal Forms for state-specific guidance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.