Loading

Get In Dor Poa-1 2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DoR POA-1 online

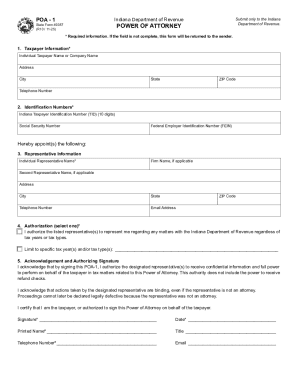

Filling out the Indiana Department of Revenue Power of Attorney (POA-1) form online is a vital step for taxpayers seeking to appoint a representative for tax matters. This guide will provide clear directions on completing each section of the form effectively.

Follow the steps to complete the IN DoR POA-1 form online.

- Click the ‘Get Form’ button to access the IN DoR POA-1 form and open it in your preferred digital editor.

- In the taxpayer information section, fill in the required fields: individual taxpayer name or company name, complete address, city, state, ZIP code, and telephone number. Ensure all fields marked with an asterisk are completed, as this form will be returned if any required information is missing.

- Next, provide the identification numbers: enter your Indiana Taxpayer Identification Number (TID), Social Security Number, and, if applicable, the Federal Employer Identification Number (FEIN). Remember that individual taxpayers should use their Social Security number unless they have a TID number.

- In the representative information section, list the name of the individual representative and the firm name if applicable. If you have a second representative, provide their details as well, including their address, city, state, ZIP code, telephone number, and email address.

- For the authorization section, select one of the two options provided. Choose the first option to authorize your representative(s) for all tax matters or the second option to limit representation to specific tax years and/or tax types. If you choose the latter, clearly specify the relevant details.

- Finally, complete the acknowledgment and authorizing signature section. Sign the form, include the date, your printed name, title (if applicable), telephone number, and email address. Make sure to complete all required fields to ensure acceptance.

- Once you have filled out the form, you can save the changes, download a copy, print it, or share it as necessary. After ensuring everything is correct, you can proceed to submit the form via fax or mail.

Start completing your IN DoR POA-1 form online today to ensure proper representation for your tax matters.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.