Get Va Dot St-18 2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT ST-18 online

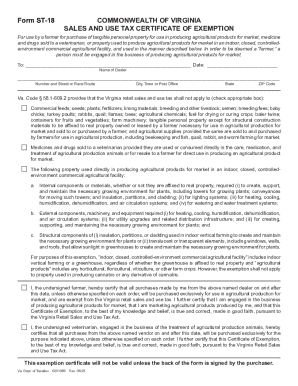

The VA DoT ST-18 form is a Sales and Use Tax Certificate of Exemption used by farmers and veterinarians in Virginia. This guide will provide you with clear, step-by-step instructions on how to fill out this form online, ensuring you understand each component and its requirements.

Follow the steps to complete the VA DoT ST-18 form easily.

- Use the 'Get Form' button to access the VA DoT ST-18 form and open it for editing.

- In the first section, enter the name of the dealer from whom you will be purchasing goods. Provide the complete address, including number and street or rural route, city or town, state, and zip code.

- Next, indicate the applicable exemptions by checking the appropriate boxes next to the items listed. Familiarize yourself with the categories such as commercial feeds, farm machinery, and medicines specifically used for agricultural production.

- In the certification section, provide your name and title as the undersigned farmer or veterinarian. Ensure you sign the form to affirm that the information you provided is correct and made in good faith.

- If applicable, enter your Virginia Account Number to identify any existing registration with the Department of Taxation. If you do not have one, simply enter 'NONE'.

- Finally, review all entered details for accuracy. Once confirmed, you can save your changes, download the completed form, print it for your records, or share it if necessary.

Start filling out your VA DoT ST-18 form online today to ensure your agricultural purchases are tax-exempt.

Virginia circuit courts handle more serious criminal cases, civil cases involving larger sums, and appeals from general district courts. In contrast, general district courts manage minor criminal offenses, smaller civil cases, and traffic violations. Understanding the distinctions aids you in navigating Virginia's legal system effectively, and the VA DoT ST-18 can offer insights into relevant procedures.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.