Loading

Get Nm Trd Rpd-41326 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM TRD RPD-41326 online

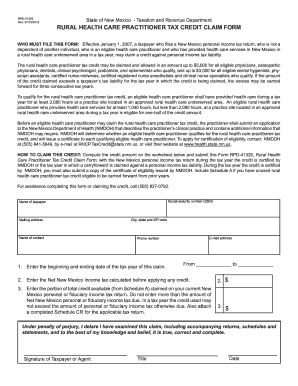

Filling out the NM TRD RPD-41326 form accurately is crucial for healthcare practitioners seeking to claim the rural health care practitioner tax credit in New Mexico. This guide will help users navigate the form with clear, step-by-step instructions to ensure a successful submission.

Follow the steps to complete the NM TRD RPD-41326 form online

- Click the ‘Get Form’ button to obtain the NM TRD RPD-41326 and open it in the designated editor.

- Enter your social security number (SSN) in the appropriate field.

- Provide your full name as the taxpayer.

- Input your mailing address, including city, state, and ZIP code.

- Include the name of your contact person if applicable.

- Fill in your email address and phone number.

- Enter the beginning and ending dates of the tax year for this claim in the designated fields.

- Calculate and enter the Net New Mexico income tax before applying any credit.

- Indicate the portion of the total credit from Schedule A that you are claiming on your current return, ensuring it does not exceed your Net New Mexico personal or fiduciary income tax due.

- Sign the form, confirming under penalty of perjury that the information provided is accurate.

- Complete Schedule A, including the certification number, date of approval, amount of credit approved, total credit claimed in previous tax years, and any unused credit.

- Attach all necessary documents such as the certificate from NMDOH and Schedule CR to your tax return.

- Review all entered information for accuracy.

- Save your changes and proceed to download, print, or share the completed form as needed.

Complete your NM TRD RPD-41326 form online today for a smoother tax credit claiming process!

Tax credits reduce your tax liability on a dollar-for-dollar basis, which can lead to significant savings. The process involves determining eligibility based on your income and expenses as specified by NM TRD RPD-41326. By accurately documenting your expenses and filing your taxes, you can take full advantage of these credits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.