Get Nm Trd Rpd-41301 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

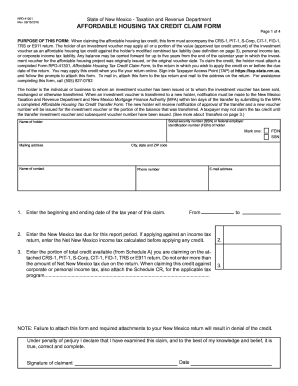

Tips on how to fill out, edit and sign NM TRD RPD-41301 online

How to fill out and sign NM TRD RPD-41301 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans are inclined to handle their own taxes and, furthermore, to complete forms electronically.

The US Legal Forms online platform simplifies the task of preparing the NM TRD RPD-41301, making it straightforward and stress-free.

Ensure that you have correctly completed and submitted the NM TRD RPD-41301 on time. Check any relevant deadline. Providing false information on your tax documents can lead to serious penalties and complications with your annual tax filing. Utilize only authorized templates from US Legal Forms!

- Access the PDF sample in the editor.

- Look at the highlighted fillable fields. This is where you enter your information.

- Select the option to choose when checkboxes appear.

- Move to the Text icon along with additional advanced features to manually adjust the NM TRD RPD-41301.

- Review all details before you continue signing.

- Create your personalized eSignature using a keyboard, digital camera, touchpad, computer mouse, or smartphone.

- Authorize your template online and indicate the specific date.

- Click on Done to proceed.

- Download or send the document to the recipient.

How to Revise Get NM TRD RPD-41301 2016: Personalize Forms Online

Forget the outdated paper-based method of completing Get NM TRD RPD-41301 2016. Have the document finalized and signed in moments with our premium online editor.

Are you required to modify and fill out Get NM TRD RPD-41301 2016? With a powerful editor like ours, you can finish this job within minutes without having to print and scan documents repeatedly. We offer you fully adjustable and easy-to-use form templates that will act as a foundation and assist you in completing the necessary form online.

All documents, automatically, contain fillable fields you can complete once you access the template. However, if you wish to enhance the existing content of the document or introduce new elements, you can choose from various customization and annotation tools. Highlight, obscure, and comment on the text; add ticks, lines, text boxes, images, notes, and remarks. Moreover, you can quickly authenticate the template with a legally-binding signature. The finalized document can be shared with others, stored, forwarded to external programs, or converted into any widely-used format.

You won’t make a mistake by utilizing our web-based solution to finalize Get NM TRD RPD-41301 2016 because it's:

Don’t waste time revising your Get NM TRD RPD-41301 2016 in the traditional way - with pen and paper. Use our comprehensive solution instead. It provides you with a versatile array of editing tools, built-in eSignature features, and convenience. What distinguishes it from similar solutions is the team collaboration capabilities - you can work on documents with anyone, create a well-organized document approval workflow from A to Z, and much more. Try our online solution and receive the best value for your investment!

- Simple to set up and operate, even for those who haven’t filled out documents electronically before.

- Robust enough to handle various editing needs and form categories.

- Safe and secure, ensuring your editing experience is protected every time.

- Accessible for different operating systems, making it easy to complete the form from anywhere.

- Capable of generating forms based on pre-prepared templates.

- Compatible with numerous file types: PDF, DOC, DOCX, PPT, and JPEG, etc.

Related links form

Gross receipts tax (GRT) operates on the total revenue generated from business activities in New Mexico. It is important to note that both the state and local governments can impose GRT, meaning rates may vary by location. Under NM TRD RPD-41301, businesses need to calculate their GRT obligations accurately to avoid penalties. Understanding these details helps ensure your business complies with tax regulations, allowing you to focus on growth.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.