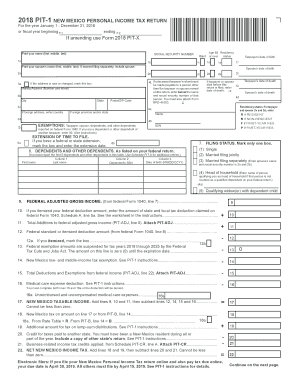

Get Nm Trd Pit-1 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NM TRD PIT-1 online

How to fill out and sign NM TRD PIT-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

In the present day, the majority of Americans choose to handle their own income tax filings and, indeed, to complete forms digitally. The US Legal Forms online service streamlines the preparation of the NM TRD PIT-1, making it quick and efficient. Currently, it takes no more than 30 minutes, and it can be done from anywhere.

Suggestions for making the NM TRD PIT-1 process swift and straightforward:

Ensure that you have accurately completed and submitted the NM TRD PIT-1 before the deadline. Be aware of any due dates. Submitting incorrect information on your tax documents can result in severe consequences and complications with your yearly tax return. Always use verified templates from US Legal Forms!

- Launch the PDF template in the editor.

- Look at the highlighted fillable sections. Here, you can enter your information.

- Select an option if you see the checkboxes.

- Utilize the Text tool and other advanced features to manually edit the NM TRD PIT-1.

- Double-check all information before proceeding to sign.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Finalize your online template electronically and indicate the date.

- Click on 'Done' to continue.

- Download or forward the document to the recipient.

How to modify Get NM TRD PIT-1 2018: personalize forms online

Explore a standalone service that handles all your documentation effortlessly. Locate, modify, and finalize your Get NM TRD PIT-1 2018 in a unified platform using intelligent tools.

The era when individuals had to print forms or manually write them is over. Nowadays, acquiring and filling any form, like Get NM TRD PIT-1 2018, requires just opening one browser tab. Here, you will find the Get NM TRD PIT-1 2018 form and tailor it in any manner you need, from inserting text directly in the document to sketching it on a digital sticky note and attaching it to the record. Uncover tools that will ease your documentation process without extra effort.

Click the Get form button to quickly prepare your Get NM TRD PIT-1 2018 documentation and start modifying it right away. In the editing mode, you can effortlessly complete the template with your information for submission. Just click on the field you wish to change and input the data immediately. The editor's interface requires no specific skills to navigate. Once you've finished the modifications, verify the information's correctness and sign the document. Click on the signature field and follow the prompts to eSign the form in no time.

Utilize Additional tools to tailor your form:

Preparing Get NM TRD PIT-1 2018 forms will never be confusing again if you know where to look for the appropriate template and get it ready swiftly. Do not hesitate to give it a try yourself.

- Employ Cross, Check, or Circle tools to locate the document's data.

- Incorporate textual content or fillable text fields with text customization tools.

- Remove, Highlight, or Obscure text sections in the document using corresponding tools.

- Insert a date, initials, or even an image into the document if needed.

- Utilize the Sticky note tool to annotate the form.

- Apply the Arrow and Line, or Draw tool to introduce visual elements to your file.

Get form

Related links form

Title 1 in New Mexico refers to the legal and regulatory framework governing taxation in the state, including the NM TRD PIT-1. It outlines the obligations and rights of taxpayers and the processes for filing taxes. Understanding this framework aids in compliance and helps you navigate your tax responsibilities effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.