Get Nm Acd-31098 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

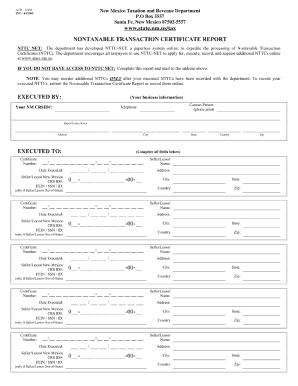

Tips on how to fill out, edit and sign NM ACD-31098 online

How to fill out and sign NM ACD-31098 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, a majority of Americans prefer to handle their own taxes and, additionally, to complete reports in digital format.

The US Legal Forms online service streamlines the e-filing process for the NM ACD-31098, making it quick and convenient.

Ensure you have accurately completed and submitted the NM ACD-31098 on time. Keep in mind any relevant deadlines. Providing incorrect information in your tax reports may lead to hefty penalties and complications with your annual tax return. Always utilize reliable templates with US Legal Forms!

- Launch the PDF form in the editor.

- Observe the highlighted fillable fields where you can enter your details.

- Select an option when you notice the checkboxes.

- Explore the Text icon and other advanced features to modify the NM ACD-31098 manually.

- Verify every piece of information prior to signing.

- Create your personalized eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authenticate your online template and indicate the date.

- Click on Done to continue.

- Store or send the document to the intended recipient.

How to Alter Get NM ACD-31098 2005: Personalize Documents Online

Explore a unified service to manage all of your documentation seamlessly. Locate, alter, and complete your Get NM ACD-31098 2005 in one platform using intelligent tools.

The era in which individuals had to print documents or even fill them out by hand is a thing of the past. Nowadays, all you need to do to acquire and finish any form, such as Get NM ACD-31098 2005, is to open a single browser tab. Here, you can access the Get NM ACD-31098 2005 document and personalize it however you wish, from inserting text directly in the file to sketching it on a digital sticky note and attaching it to the document. Uncover tools that will enhance your documentation process effortlessly.

Click the Get form button to prepare your Get NM ACD-31098 2005 paperwork swiftly and begin altering it right away. In the modification mode, you can conveniently fill out the template with your details for submission. Simply click on the area you want to modify and input the information immediately. The editor's interface requires no specialized skills to navigate. Once you have completed the changes, verify the information's correctness once more and sign the document. Click on the signature field and follow the prompts to eSign the form in no time.

Utilize additional tools to personalize your document:

Preparing Get NM ACD-31098 2005 paperwork will never be challenging again if you know where to find the right template and complete it effortlessly. Do not hesitate to give it a try.

- Employ Cross, Check, or Circle tools to highlight the document's data.

- Insert textual content or fillable text areas with text customization features.

- Remove, Highlight, or Blackout text sections in the document using the respective tools.

- Include a date, initials, or even an image to the document if necessary.

- Utilize the Sticky note tool to comment on the form.

- Use the Arrow and Line, or Draw tool to add graphical elements to your file.

Get form

Related links form

When asked if you are exempt from withholding, you should truthfully assess your tax situation. If you meet the criteria listed in the NM ACD-31098 for exemption, you can answer affirmatively and provide proof if required. If unsure, consult the guidelines or a tax advisor to ensure compliance with tax laws.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.