Get Nm Acd-31098 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

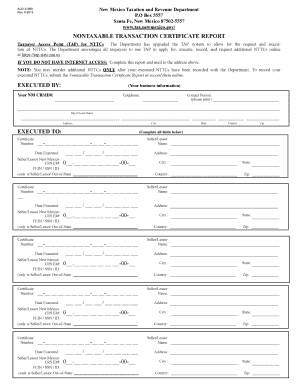

Tips on how to fill out, edit and sign NM ACD-31098 online

How to fill out and sign NM ACD-31098 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans choose to handle their own tax returns and, in fact, to complete forms digitally.

The US Legal Forms online platform facilitates the e-filing of the NM ACD-31098 by making the process simple and convenient.

Ensure that you have accurately completed and submitted the NM ACD-31098 within the specified timeframe. Check for any relevant deadlines. Providing incorrect information on your tax documents may result in severe penalties and complications with your yearly tax filing. Always utilize only professional templates available through US Legal Forms!

- Open the PDF document in the editor.

- Look at the highlighted fillable areas. This is where you should input your information.

- Select the checkboxes if they are visible.

- Explore the Text icon and various advanced features to adjust the NM ACD-31098 manually.

- Review every detail before proceeding to sign.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your online template and indicate the date.

- Click on Done to proceed.

- Save or send the document to the recipient.

How to modify Get NM ACD-31098 2015: personalize forms online

Utilize the capabilities of the feature-rich online editor while finalizing your Get NM ACD-31098 2015. Employ the diverse tools to swiftly complete the fields and supply the necessary details promptly.

Drafting documents is labor-intensive and costly unless you possess pre-prepared fillable forms and finalize them digitally. The most efficient method to handle the Get NM ACD-31098 2015 is to utilize our expert and versatile online editing solutions. We equip you with all the essential tools for rapid document completion and enable you to make any modifications to your forms, adjusting them to any requirements. Furthermore, you can provide feedback on the modifications and leave notes for other participants involved.

Here’s what you can achieve with your Get NM ACD-31098 2015 in our editor:

Managing the Get NM ACD-31098 2015 in our robust online editor is the quickest and most productive way to handle, submit, and share your documentation the way you need it from anywhere. The tool functions from the cloud so you can access it from any location on any internet-enabled device. All forms you create or fill are securely stored in the cloud, allowing you to retrieve them whenever needed and ensuring they are not lost. Stop squandering time on manual document completion and eliminate paperwork; do it all online with minimal effort.

- Fill in the fields using Text, Cross, Check, Initials, Date, and Sign tools.

- Emphasize important information with a chosen color or underline them.

- Obscure sensitive information using the Blackout tool or simply delete them.

- Insert images to illustrate your Get NM ACD-31098 2015.

- Substitute the original text with content that meets your requirements.

- Add remarks or sticky notes to inform others about the changes.

- Create extra fillable sections and designate them to particular recipients.

- Secure the template with watermarks, date stamps, and bates numbers.

- Distribute the documentation in multiple ways and save it on your device or in the cloud in various formats as soon as you complete editing.

To obtain a New Mexico tax ID number, you can apply online through the New Mexico Taxation and Revenue Department's website or submit a paper application. It's important to have your business information handy, as you will need it to complete the application. Using resources like uslegalforms can streamline this process and help ensure you follow the guidelines of NM ACD-31098 correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.