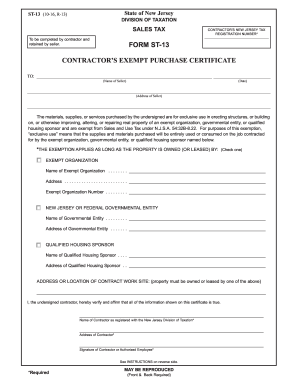

Get Nj St-13 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NJ ST-13 online

How to fill out and sign NJ ST-13 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans opt to handle their own tax returns and additionally, to complete forms electronically.

The US Legal Forms online service facilitates a swift and efficient submission of the NJ ST-13 form.

Ensure that you have accurately completed and submitted the NJ ST-13 before the deadline. Review any relevant timing. If you input incorrect information in your fiscal documents, it may lead to significant penalties and complications with your annual tax filing. Always utilize professional templates from US Legal Forms!

- Open the PDF template in the editor.

- Look at the designated fillable areas. Here you can enter your information.

- Select the option if you notice the checkboxes.

- Explore the Text tool and other robust features to edit the NJ ST-13 manually.

- Review all the details before proceeding with your signature.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authenticate your document electronically and include the specific date.

- Press Done to proceed.

- Download or forward the document to the intended recipient.

How to Revise Get NJ ST-13 2016: Personalize Forms on the Web

Streamline your file preparation process and tailor it to your specifications in just a few clicks. Complete and sign Get NJ ST-13 2016 with a powerful yet user-friendly online editor.

Dealing with documentation is always challenging, particularly when you handle it occasionally. It requires you to strictly comply with all the regulations and accurately fill in all sections with complete and correct information. However, it frequently happens that you need to alter the form or add additional sections to fill. If you wish to enhance Get NJ ST-13 2016 before submitting it, the easiest method is by utilizing our robust yet straightforward online editing tools.

This comprehensive PDF editing tool allows you to swiftly and effortlessly complete legal documents from any internet-enabled device, make basic adjustments to the template, and insert more fillable fields. The service permits you to select a specific area for each data type, such as Name, Signature, Currency, and SSN, etc. You can designate them as mandatory or conditional and determine who should fulfill each field by assigning them to a particular recipient.

Our editor is an all-encompassing multi-functional online solution that can assist you in efficiently and expediently enhancing Get NJ ST-13 2016, along with other templates according to your needs. Improve document preparation and submission duration and ensure your paperwork appears professional without complications.

- Access the required file from the directory.

- Populate the empty spaces with Text and drag Check and Cross tools to the checkboxes.

- Utilize the right-side panel to modify the form by adding new fillable sections.

- Select the fields based on the category of information you wish to gather.

- Set these fields as mandatory, optional, or conditional, and arrange their sequence.

- Assign each field to a specific party using the Add Signer tool.

- Confirm that you have made all the necessary modifications and click Done.

To file for the NJ anchor program, you need to meet specific eligibility criteria related to your income and property taxes. This program aims to provide relief to qualifying homeowners and renters in New Jersey. Visit the NJ ST-13 guidelines for further details on the filing process and required documentation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.