Loading

Get Nj St-13 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ ST-13 online

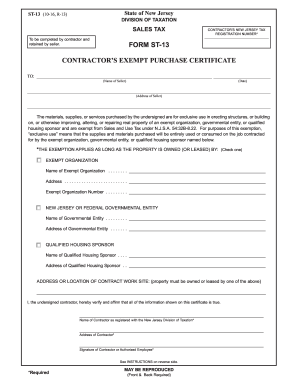

Filling out the NJ ST-13 form, also known as the Contractor's Exempt Purchase Certificate, is essential for contractors looking to make exempt purchases for projects involving exempt organizations or governmental entities. This guide will walk you through the online process of completing this form accurately and efficiently.

Follow the steps to fill out the NJ ST-13 online.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- In the first section, enter the contractor’s New Jersey tax registration number in the designated field.

- Fill in the name of the seller, including the date and address of the seller. Ensure all information is accurate and complete.

- Indicate the purpose of the purchase by checking the appropriate box for exempt organization, governmental entity, or qualified housing sponsor. Provide the corresponding name and address in the fields provided.

- Describe the location of the contract work site where the exempt materials or services will be used.

- Verify and confirm the accuracy of all information provided by including your name as registered with the New Jersey Division of Taxation, and the address for the contractor.

- Finally, sign the form either as the contractor or an authorized employee. Save your changes and download a copy of the completed form for your records.

Complete your NJ ST-13 form online now to ensure a smooth purchasing process.

To file for the NJ anchor program, you need to meet specific eligibility criteria related to your income and property taxes. This program aims to provide relief to qualifying homeowners and renters in New Jersey. Visit the NJ ST-13 guidelines for further details on the filing process and required documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.