Get Nj Reg-1e 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ REG-1E online

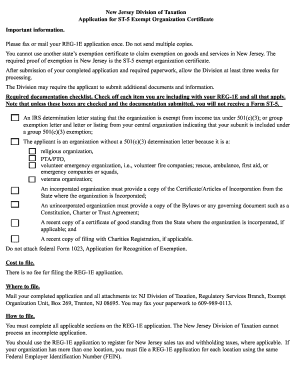

The NJ REG-1E form is essential for organizations seeking a sales tax exemption in New Jersey. This comprehensive guide will assist you in navigating the process of completing the form online, ensuring that all necessary information is accurately provided.

Follow the steps to accurately complete the NJ REG-1E form online.

- Click ‘Get Form’ button to access the NJ REG-1E application and open it in your preferred editor.

- Enter the 'Organization Name' in the designated field. This should reflect the official name of your organization as registered.

- If applicable, provide your 'FEIN' (Federal Employer Identification Number) in the next field.

- If your organization has a registered corporate alternate name, fill in that information next.

- Complete the 'Physical Location' section with the address where your organization operates, or you can use an officer’s address.

- Fill out the address where the ST-5 is to be mailed, ensuring accuracy to avoid delays.

- Choose the appropriate 'County/Municipality/or Out-of-State Code'. Refer to the provided list before selecting the correct code.

- Indicate whether you will collect New Jersey sales tax by selecting 'Yes' or 'No'. If 'Yes', provide the date of the first sale.

- Answer if you will begin paying wages or salaries to employees in New Jersey, and provide the relevant dates.

- If applying as a corporation, specify the state of incorporation and attach a copy of the Certificate/Articles of Incorporation.

- Designate a contact person by entering their name, email address, and daytime phone number.

- Provide details for two responsible officers of your organization, including their names, titles, and addresses.

- Certify the correctness of the application by signing in the designated field and providing your printed name, title, and date.

- Once all sections are completed, review the application for accuracy. You can then save changes, download, print, or share the form as needed.

Complete your NJ REG-1E application online today to ensure your organization qualifies for sales tax exemption!

In New Jersey, seniors may qualify for property tax relief programs, but they do not completely stop paying property taxes based on age alone. The New Jersey property tax reimbursement program is available for seniors age 65 or older, which can alleviate some of their tax burden. Always review the necessary forms, such as the NJ REG-1E, to understand the specifics of eligibility. Staying informed can greatly aid in reducing overall property taxes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.