Loading

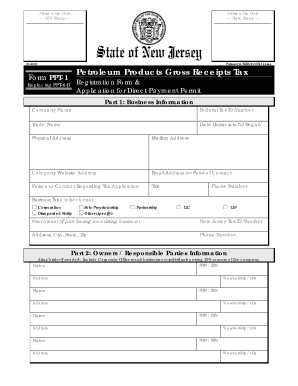

Get Nj Ppt-1 (formerly Ppt-6-b) 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ PPT-1 (Formerly PPT-6-B) online

Filling out the NJ PPT-1 form correctly is crucial for businesses seeking to register for the Petroleum Products Gross Receipts Tax and apply for a Direct Payment Permit. This guide provides step-by-step instructions to help you navigate the process with confidence.

Follow the steps to complete the NJ PPT-1 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Complete Part 1: Business Information. Provide details such as your company name, federal tax ID number, trade name, and addresses (physical and mailing). Don’t forget to include your email address for contact and the business type.

- In Part 2: Owners / Responsible Parties Information, list individuals or businesses who own 10% or more of the company. Ensure to attach a rider if you have more individuals to include.

- In Part 3: Business Activities, describe the business model and regular activities, and list your intended suppliers, customers, and products you plan to sell.

- For Part 4: Application for Direct Payment Permit, indicate whether your business is requesting a Direct Payment Permit or simply needs to register for the Petroleum Products Gross Receipts Tax.

- Complete Part 5: Affirmation by having the owner or authorized officer sign and print their name and title, affirming the completeness and accuracy of the information provided.

- Finally, save your changes, and you can either download, print, or share the completed form as needed.

Complete the NJ PPT-1 form online today to ensure your business is properly registered.

New Jersey has a fuel tax levied on gasoline and diesel fuel. This tax helps fund transportation projects and maintenance of infrastructure throughout the state. Staying informed about the fuel tax not only assists in compliance but also relates to the details covered under NJ PPT-1 (Formerly PPT-6-B).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.