Get Nj Ifta Quarterly Tax Return 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ IFTA Quarterly Tax Return online

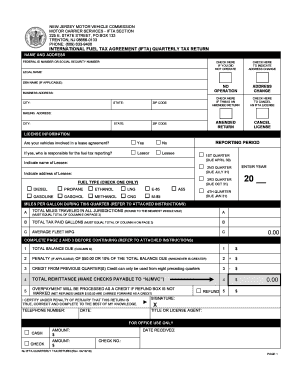

Filling out the New Jersey International Fuel Tax Agreement (IFTA) Quarterly Tax Return online can be a straightforward process when approached methodically. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your NJ IFTA Quarterly Tax Return online

- Press the ‘Get Form’ button to obtain the NJ IFTA Quarterly Tax Return form and open it in the editor.

- Enter your federal ID number or social security number in the designated field. This should match the number on your legal documents.

- Fill in your legal name exactly as it appears on your legal documents. If you have a ‘doing business as’ (DBA) name, include that next.

- Provide your business address, including the city, state, and zip code. Ensure this address is the primary location for your business as required by legal documentation.

- Mark the appropriate checkbox if you did not operate any qualified vehicles during the reporting period.

- If applicable, indicate if this is an amended return by checking the appropriate box and provide details of the quarter and year you are correcting.

- If you have changed your address, check the box provided and enter your new mailing address in the corresponding fields.

- Select whether your vehicles were involved in a lease agreement and specify who is responsible for fuel tax reporting.

- Choose the type of fuel you used during the reporting period by checking the corresponding box.

- Select the appropriate reporting period for your tax return and enter the year. Ensure that your selection aligns with the quarters due.

- Calculate and enter the total miles traveled during this quarter in the specified field, rounding to the nearest whole mile.

- Fill in the total tax paid gallons, ensuring it matches the total of the values from the later columns in this form.

- Calculate your average fleet miles per gallon (MPG) by dividing total miles traveled by total tax paid gallons, rounding to two decimal points.

- Complete the necessary calculations on pages 2 and 3, ensuring all figures align appropriately with the provided instructions.

- Review all entries for accuracy before submitting. Save any changes made in the form.

- Download and print the completed form or save it to share via email, if necessary.

Complete your NJ IFTA Quarterly Tax Return online today to ensure timely and accurate filing!

Calculating IFTA fuel tax involves taking your total fuel consumption and the miles traveled, then applying the relevant tax rates for each jurisdiction. You can use a simple formula: total gallons purchased divided by total miles traveled, multiplied by the state tax rates. Utilizing services like US Legal Forms can help you ensure you calculate and report your NJ IFTA Quarterly Tax Return accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.