Loading

Get Ca Ftb 3587 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3587 online

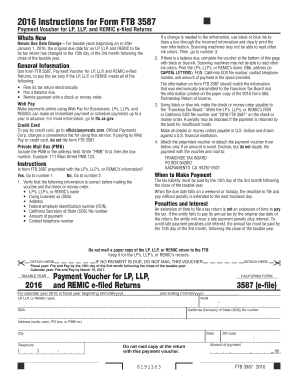

Filling out the CA FTB 3587 is an essential step for limited partnerships (LP), limited liability partnerships (LLP), and real estate mortgage investment conduits (REMIC) that have e-filed their tax returns. This guide provides you with step-by-step instructions to complete the form accurately and efficiently online.

Follow the steps to complete the CA FTB 3587 online.

- Click ‘Get Form’ button to access the CA FTB 3587 form and open it online in the document editor.

- If the form is preprinted with the LP’s, LLP’s, or REMIC’s information, verify that the details such as name, doing business as (DBA), address, federal employer identification number (FEIN), California Secretary of State (SOS) file number, amount of payment, and contact telephone number are accurate before proceeding.

- If any information needs to be corrected, use black or blue ink to clearly draw a line through the incorrect details and print the correct information. After making the necessary changes, move to the next section.

- If there is a balance due, fill out the voucher at the bottom of the form using black or blue ink. Ensure that the LP’s, LLP’s, or REMIC’s name, DBA, address (in capital letters), FEIN, California SOS file number, contact telephone number, and amount of payment are correctly entered in the designated fields.

- Create your payment by making a check or money order payable to the ‘Franchise Tax Board.’ Indicate the LP’s, LLP’s, or REMIC’s FEIN or California SOS file number along with ‘2016 FTB 3587’ on the payment.

- If applicable, attach the preprinted voucher or detach the payment voucher from the document, ensuring you do not staple the payment to the voucher before mailing it to the provided address.

- Mail the payment voucher along with the payment to the Franchise Tax Board, ensuring that it is done by the due date to avoid penalties.

- Finally, keep a copy of the completed CA FTB 3587 for your records, but do not send the original return to the FTB.

Complete your CA FTB 3587 online today and ensure timely submission to avoid penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The payment voucher for LLC e-filed returns allows limited liability companies to remit their tax payments when e-filing. This voucher serves as a critical tool for appropriate tax payment processing, similar to the individual process governed by CA FTB 3587. It assures that your payment is correctly accounted for by the Franchise Tax Board.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.