Loading

Get Nj Form Ptr-1 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ Form PTR-1 online

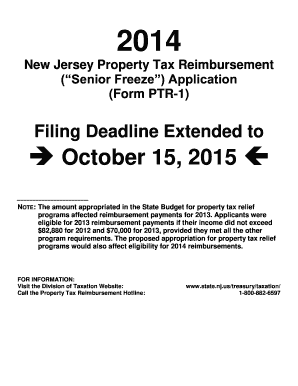

Filling out the NJ Form PTR-1 is an essential step for qualifying applicants seeking property tax reimbursement. This guide will walk you through each section of the form, ensuring you complete it accurately and effectively for online submission.

Follow the steps to successfully complete your NJ Form PTR-1 online.

- Click the ‘Get Form’ button to obtain the form and open it in your online editor.

- Enter your social security number in the designated field, making sure to enter one digit in each box.

- Complete the name and address section by printing or typing your name as shown on your property tax bills and ensuring that all information is accurate.

- Indicate your marital or civil union status on December 31 of 2013 and 2014 by selecting the appropriate options.

- Fill in your age or disability status, confirming whether you were 65 or older or receiving Social Security benefits during the specified dates.

- Answer the residency requirement questions, verifying that you have lived in New Jersey and owned the same home during the relevant time periods.

- List all sources of income for both 2013 and 2014, adding the amounts to determine your total income for each year and ensuring it falls within the eligibility limits.

- Provide details about your principal residence, including the block and lot numbers, and indicate the total property taxes paid for both years.

- Review all information to ensure accuracy and completeness, sign the application, and enclose any required documentation.

- Once completed, you can save, download, or print the form for submission.

Start filling out your NJ Form PTR-1 online today to secure your property tax reimbursement!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To qualify for the NJ senior property tax freeze, applicants must be at least 65 years old and have lived in their home for at least the previous year. Moreover, participants must meet income limitations set by the state, which is also reviewed through the NJ Form PTR-1 application. This freeze aims to prevent property taxes from increasing, ensuring stability for eligible seniors.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.