Loading

Get Nj Form A-1 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ Form A-1 online

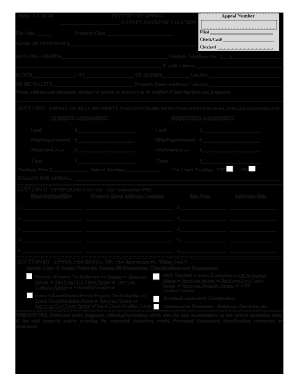

Filling out the NJ Form A-1 online can be a straightforward process when guided properly. This guide will assist you in navigating the form effectively, ensuring that all necessary information is accurately provided for your appeal.

Follow the steps to complete the NJ Form A-1

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter the tax year and appeal number at the top of the form. You will need to provide your property class and specify the method of payment, whether check or cash.

- Fill in the name of the petitioner, including the last and first name, followed by your mailing address, daytime telephone number, and email address.

- Indicate the block, lot, and qualifier related to your property, along with the municipal details and the street address or location.

- In the first section for appeal of real property valuation, provide the current assessment and requested assessment for both land and buildings/improvements. Fill in the total values accordingly.

- If applicable, enter the purchase price of the property and the date of purchase. Specify whether a tax court case is pending.

- State your reason for the appeal clearly in the given section.

- In the second section, list comparable sales up to five properties, including their block, lot, street address, sale price, and sale/deed date.

- If appealing a denial, complete Section III by attaching a copy of the denial notice and selecting the appropriate deductions or exemptions applicable to your situation.

- Review the entire form for accuracy, ensuring all required signatures are present, and save your changes. You may then download, print, or share the completed form as necessary.

Complete your NJ Form A-1 online today to ensure your appeal is filed correctly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you are a resident of NJ, according to the NJ department of revenue, you are required to file an NJ resident state income tax return if: your filing status is married filing jointly and your gross income from everywhere for the entire year was more than the filing threshold of $20,000.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.