Loading

Get Nj Form A-1 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ Form A-1 online

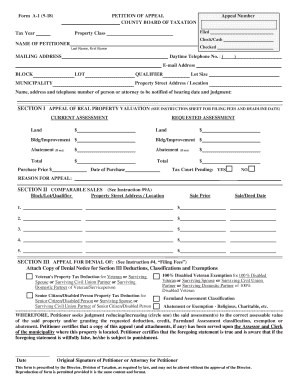

This guide provides step-by-step instructions on how to complete the NJ Form A-1, a petition of appeal for property tax assessment. Whether you are a first-time user or familiar with the process, this guide aims to simplify your experience in filling out the form online.

Follow the steps to successfully complete NJ Form A-1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the tax year and the appeal number fields accurately, as these are essential for processing your appeal.

- Provide your name and mailing address in the designated fields. Make sure that the contact information is correct, including your daytime telephone number and email address.

- Input the block, lot, and qualifier details of the property you are appealing. Include the municipality name and the property street address.

- Continue to Section I, where you will list the current assessment and the requested assessment for both land and building/improvement. Be sure to include any abatement amounts where applicable.

- In Section II, document comparable sales that support your appeal. List the block/lot/qualifier, property street address, sale price, and sale/deed date for each comparable property.

- If you are appealing a denial, complete Section III by attaching a copy of the denial notice and checking the appropriate boxes regarding the nature of the denial.

- Complete the reason for appeal field with a clear and concise statement explaining why you believe the assessment should be adjusted.

- Finally, review all the information for accuracy, enter the date and provide your original signature or that of your attorney.

- Once you have completed all sections, you can save your changes, download the form, print it for submission, or share it as required.

Take the first step today and complete your NJ Form A-1 online for a smoother appeal process.

Does New Jersey require state 1099 tax filing? Yes, New Jersey requires you to file 1099s to the Department of the Treasury.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.