Loading

Get Nj Ebf-1 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ EBF-1 online

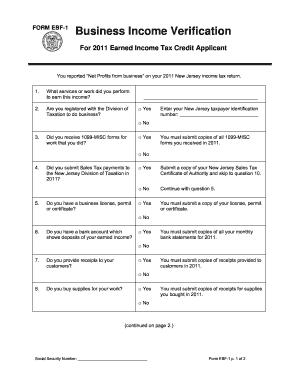

The NJ EBF-1 form is essential for individuals claiming the Earned Income Tax Credit based on business income. This guide provides a clear, step-by-step approach to completing the online version of this form accurately.

Follow the steps to successfully complete the NJ EBF-1 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the section asking about the nature of your business, provide a brief description of the services or work you performed to generate the reported net profits.

- Indicate whether you are registered with the Division of Taxation to conduct business, selecting either ‘Yes’ or ‘No’. If yes, enter your New Jersey taxpayer identification number.

- Respond to whether you received 1099-MISC forms for your work. If yes, ensure to submit copies of all 1099-MISC forms you received in 2011.

- Answer whether you submitted Sales Tax payments to the New Jersey Division of Taxation in 2011. If yes, provide a copy of your Sales Tax Certificate of Authority.

- State if you possess a business license, permit, or certificate and provide a copy if applicable.

- Confirm whether you have a bank account that shows deposits of your earned income. If yes, you must submit copies of all your monthly bank statements for 2011.

- Indicate if you provide receipts to customers. If yes, ensure to submit copies of the receipts you provided in 2011.

- Mention if you purchase supplies for your work and supply receipts for any purchases made in 2011 if applicable.

- Provide a list of your main clients or customers during 2011, including their names, addresses, phone numbers, payment frequency, and total amounts received.

- Certify that all information contained in the document is true by signing, entering your social security number, the date, and your daytime contact telephone number.

- After reviewing all entries for accuracy, you can save your changes, download the completed form, print, or share it as needed.

Complete your NJ EBF-1 form online today to ensure your Earned Income Tax Credit application is processed smoothly.

Yes, New Jersey does offer the option for direct deposit of rebate checks, providing a faster and more secure method of receiving funds. When applied, this feature can significantly enhance your experience, particularly if you are part of programs like NJ EBF-1. Be sure to check your preferences on the application form to opt for direct deposit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.