Loading

Get Ca Ftb 3582 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3582 online

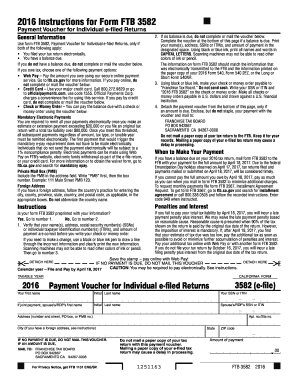

Filling out the CA FTB 3582 form is essential for individuals who have a balance due after filing their tax return electronically. This guide will walk you through each step to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the CA FTB 3582 form online.

- Click ‘Get Form’ button to obtain the form and open it in your document management system.

- Verify that you have a balance due. If not, do not complete or submit the voucher.

- Make your payment using a check or money order, payable to 'Franchise Tax Board.' Ensure you write your SSN or ITIN and '2016 FTB 3582' on the payment.

- Detach the payment voucher from the form if you have an amount due. Enclose your payment without staples and prepare it for mailing to the Franchise Tax Board at the specified address.

- Ensure you do not mail a paper copy of your tax return with the voucher, as this may delay processing.

- After filling out the form, you can choose to save changes, download, print, or share the form as needed.

Complete your CA FTB 3582 form online to ensure timely processing of your payments.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

California’s e-filing requirement mandates that most individual taxpayers must file their state tax returns electronically if they meet specific criteria, such as income thresholds. The CA FTB 3582 advises utilizing e-filing platforms, which provide secure and efficient submission methods. This requirement aims to streamline the filing process while enhancing accuracy and compliance with state tax laws.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.