Loading

Get Nj Dot It-r 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ DoT IT-R online

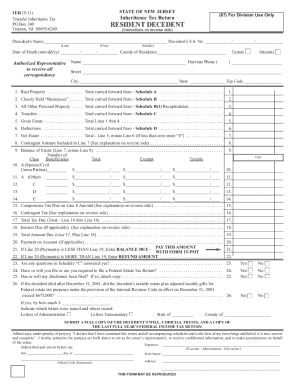

Filling out the NJ Department of Taxation's IT-R form can seem daunting, but with the right guidance, you can complete it accurately and efficiently. This form is essential for reporting the inheritance tax for transfers of property from a decedent to their beneficiaries in New Jersey.

Follow the steps to efficiently complete the NJ DoT IT-R form.

- Click the ‘Get Form’ button to access the IT-R form and open it in your preferred document editor.

- Begin by entering the decedent's name and social security number in the designated fields at the top of the form. Ensure that the name is spelled correctly.

- Input the date of death and the county of residence of the decedent. This information is crucial for proper processing.

- Indicate whether the decedent died testate (with a will) or intestate (without a will) by marking the appropriate box.

- Proceed to list all real property owned by the decedent on Schedule A, including full assessed values. Be thorough in describing each property.

- Complete Schedule B for any closely held businesses, specifying details like the market value at the date of death.

- Fill out Schedule B(1), which recapitulates all other personal property, ensuring that you document bank accounts, stocks, and other holdings accurately.

- In Schedule C, answer all questions related to transfers made by the decedent within the relevant time period and provide details for any that apply.

- Move to Schedule D to claim any deductions, such as funeral expenses and debts owed by the decedent at the time of death.

- In Schedule E, list all beneficiaries with their full names and relationships to the decedent. Ensure that each beneficiary's information is complete and accurate.

- Review all entries for accuracy. Attach any necessary supporting documents, including the decedent's last will and testament.

- Sign and date the return, having it notarized to validate the document.

- Submit the completed form, along with any required payment, to the appropriate division as indicated in the instructions.

Begin filling out the NJ DoT IT-R online today to ensure compliance with inheritance tax regulations.

If you're wondering about your NJ tax refund status, you can easily check it online through the NJ Division of Taxation website. You'll need your Social Security number and filing details. If there are any issues with your refund, the site will provide guidance on the next steps.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.