Loading

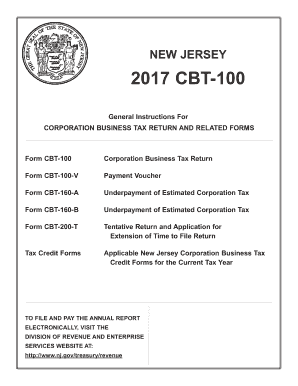

Get Nj Cbt-100 Instructions 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ CBT-100 Instructions online

This guide provides a clear, step-by-step approach to filling out the NJ CBT-100 Instructions online, aimed at ensuring users can navigate and complete the Corporation Business Tax Return with confidence. Whether you are a seasoned taxpayer or new to the process, this comprehensive guide is designed to assist you.

Follow the steps to successfully complete your NJ CBT-100 Instructions online.

- Use the ‘Get Form’ button to access the NJ CBT-100 Instructions and open the form in your editing tool of choice.

- Begin by accurately entering your Federal Employer Identification Number, New Jersey Corporation Number, corporation name, and address in the designated fields.

- Provide the principal business activity code from your Federal tax return, ensuring to include the corporation books' location, along with a contact person and telephone number.

- Complete all applicable schedules and questions as specified, marking any applicable sections. Remember to provide answers even when the response is 'No' or 'None' to avoid blanks.

- If your corporation was inactive throughout the covered period, submit only the basic pages of the return along with Schedule I, Certification of Inactivity.

- Check the due dates listed for your accounting periods and ensure your return is filed in a timely manner, taking note of deadlines to avoid penalties.

- After completing the form, review all entries for accuracy, save any changes, and proceed to download or print your completed return.

- Share the completed form as required, ensuring that any accompanying schedules and forms are included.

Complete your NJ CBT-100 Instructions online today for a hassle-free tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In New Jersey, processing times for amended tax returns can vary, but it often takes several weeks. After submitting your amended return, you can typically expect updates regarding your status. Using the NJ CBT-100 Instructions can help streamline your submission and minimize processing delays.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.