Loading

Get Nh Dp-2848 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NH DP-2848 online

This guide provides clear, step-by-step instructions for users looking to complete the NH DP-2848 online. The process is straightforward, ensuring that all necessary information is accurately submitted to the New Hampshire Department of Revenue Administration.

Follow the steps to successfully complete your NH DP-2848 form.

- Click the ‘Get Form’ button to obtain the NH DP-2848 form and access it in your preferred online format.

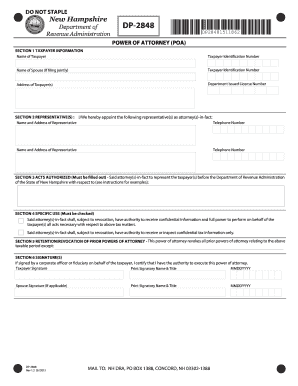

- In Section 1, enter the taxpayer’s name, taxpayer identification number, and address, including ZIP code. If applicable, also provide the spouse's name and taxpayer identification number.

- Proceed to Section 2. Indicate the names, addresses, and telephone numbers of the representative(s) you are appointing. Ensure the correct designation of individual representatives or firms.

- In Section 3, clearly specify the acts authorized by detailing the subject matter, tax types, and relevant years or periods for which you are granting authority.

- Check the appropriate box in Section 4 to indicate the level of authority your representative should have regarding confidential information.

- Review Section 5 to establish if this power of attorney will revoke any prior powers of attorney. Add any exceptions as necessary.

- Complete Section 6 by providing your signature, printed name, title, and date. If a spouse is applicable, include their signature and information as well.

- If your chosen representative is not a licensed attorney, CPA, or enrolled agent, include signatures from two witnesses as required.

- Once completed, save, download, print, or share the form as necessary, and follow the filing instructions provided, sending the document through mail or email.

Complete your NH DP-2848 online today for a streamlined and efficient tax representation process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In New Hampshire, S Corporation distributions are not subject to personal income tax, as the state does not impose an income tax on individuals. However, it is vital to ensure compliance with all business-related tax obligations that may apply. Use the NH DP-2848 to navigate your filing correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.