Get Nh Dp-2848 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NH DP-2848 online

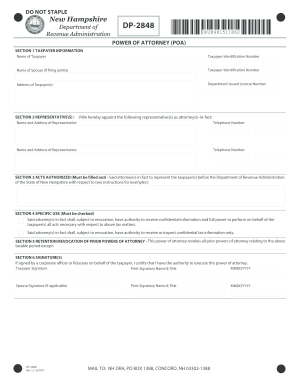

Filling out the NH DP-2848 form, also known as the Power of Attorney for tax matters, is an essential process for individuals who want to authorize a representative to act on their behalf. This guide provides a clear and supportive approach to completing the form online, ensuring all necessary information is provided accurately.

Follow the steps to fill out the NH DP-2848 online effectively.

- Press the ‘Get Form’ button to access and open the NH DP-2848 form in your preferred editing tool.

- In Section 1, enter the taxpayer's information, including their name, taxpayer identification number, and address. If filing jointly, include the spouse's name and taxpayer identification number as well.

- In Section 2, input the name, address, and telephone number of the representative(s). If entering a firm, indicate the firm name to allow communication with any member of that firm.

- In Section 3, describe the acts authorized clearly, including the relevant tax types and periods. This section must be completed to specify the scope of authority granted.

- In Section 4, check the appropriate box to indicate whether the representative will have full authority or limited to receiving confidential information only.

- In Section 5, confirm that all prior powers of attorney related to the same matters are revoked unless specified otherwise.

- In Section 6, ensure that the taxpayer and spouse (if applicable) sign and date the form, certifying the authority to execute it. If required, include two witnesses.

- Once all sections are completed, save any changes, and prepare to submit the form. You can download, print, or share the completed NH DP-2848 as needed.

Start completing your NH DP-2848 online today to ensure your tax representation is properly authorized.

Get form

Related links form

In New Hampshire, S Corp distributions are generally not subject to state income tax. However, it's crucial to understand how these distributions align with federal tax regulations. The NH DP-2848 form helps you stay compliant with tax rules while managing the timing of your distributions. For detailed assistance, US Legal Forms can provide resources specifically tailored for S Corporations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.