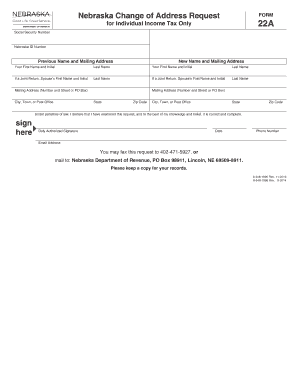

Get Ne Form 22a 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NE Form 22A online

How to fill out and sign NE Form 22A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of individuals in the United States tend to choose managing their own taxes and, additionally, completing documents in digital format.

The US Legal Forms online platform simplifies the task of submitting the NE Form 22A, making it straightforward and devoid of complications. Now it can be done in a maximum of 30 minutes, and you can do it from any location.

Ensure that you have accurately completed and submitted the NE Form 22A by the deadline. Keep any due dates in mind. Providing inaccurate information in your financial documents can lead to significant penalties and complications with your yearly tax filing. Only use reputable templates available through US Legal Forms!

- Open the PDF template in the editor.

- Look at the designated fillable lines. This is where you will insert your information.

- Select the option when you encounter the checkboxes.

- Navigate to the Text icon and other robust features to modify the NE Form 22A manually.

- Verify all information before proceeding to sign.

- Create your unique eSignature using a keyboard, digital camera, touchpad, mouse, or smartphone.

- Authenticate your online document and specify the date.

- Click on Done to continue.

- Download or forward the document to the intended recipient.

How to modify Get NE Form 22A 2016: personalize forms online

Your swiftly adjustable and customizable Get NE Form 22A 2016 template is within easy access. Utilize our collection featuring a built-in online editor.

Do you procrastinate finishing Get NE Form 22A 2016 because you simply lack direction on how to proceed? We empathize with your emotions and provide an outstanding tool that has nothing to do with overcoming your delay!

Our online directory of ready-made templates allows you to navigate and select from thousands of fillable forms designed for various purposes and situations. However, acquiring the document is merely the beginning. We provide you with all the essential features to complete, certify, and modify the form of your choice without leaving our site.

All you need to do is access the form in the editor. Review the language of Get NE Form 22A 2016 and confirm whether it meets your needs. Start altering the template using the annotation tools to give your form a more structured and polished appearance.

In summary, along with Get NE Form 22A 2016, you will receive:

With our professional service, your completed forms are typically officially binding and entirely encrypted. We prioritize the protection of your most sensitive information.

Acquire everything necessary to create a professional-looking Get NE Form 22A 2016. Make the optimal choice and explore our system now!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, obscure, and amend the existing text.

- If the form is intended for others, you can incorporate fillable fields and distribute them for other parties to complete.

- Once you finish altering the template, you can download the file in any available format or select any sharing or delivery options.

- A comprehensive set of editing and annotation tools.

- An integrated legally-binding eSignature solution.

- The capability to create forms from scratch or based on the pre-uploaded template.

- Compatibility with various platforms and devices for enhanced convenience.

- Multiple options for securing your documents.

- A variety of delivery options for seamless sharing and distribution of documents.

- Adherence to eSignature laws governing the application of eSignature in digital transactions.

Related links form

Yes, Nebraska requires the filing of 1099 forms for certain payments made throughout the year, similar to federal requirements. This ensures compliance with both state and federal tax regulations. By keeping informed about NE Form 22A, you can make sure you meet all necessary filing requirements easily.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.